Gnesist Remote Bookkeeping Services: Made Simple, Secure, Efficient, and Reliable

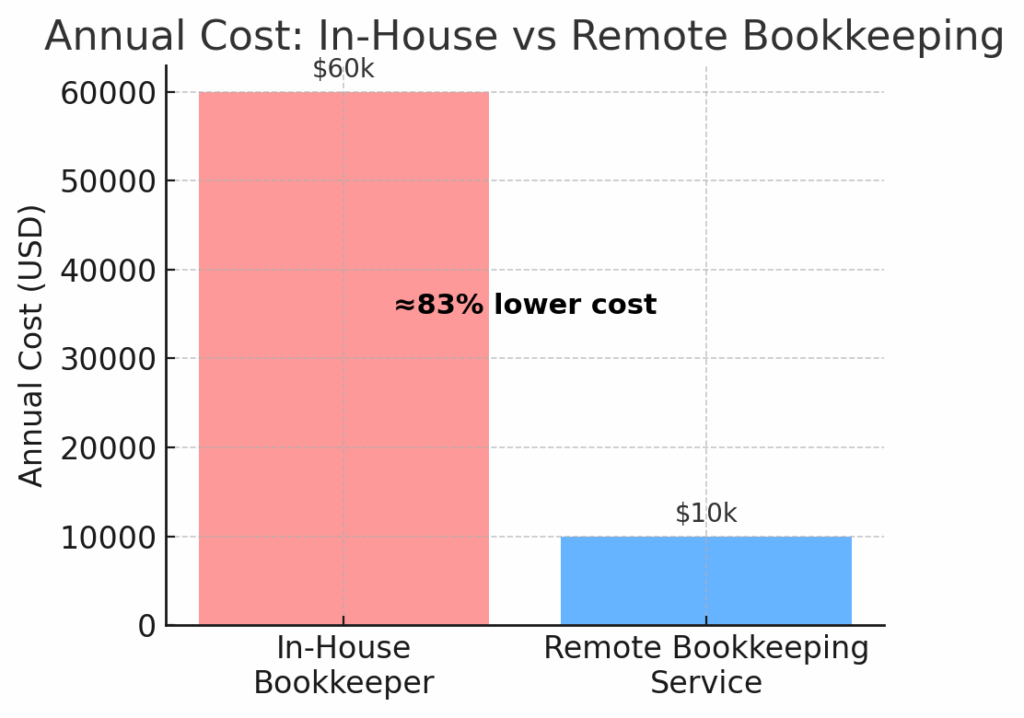

Remote bookkeeping services can save your business over 83% compared to maintaining an in-house bookkeeper. With basic online bookkeeping services available for as little as $200 to $500 per month, companies gain expert financial management at a fraction of the cost of a full-time staff member. The rise of virtual bookkeeping has revolutionized how businesses handle their finances. Online bookkeeping offers a cost-effective alternative to traditional in-house accounting services.

Quality is not sacrificed, either. Only about 2% of candidates pass the strict vetting process to become remote bookkeepers for top providers. Your business can be 20× more efficient by partnering with a virtual bookkeeping service. This will eliminate weeks spent reviewing resumes and managing in-house staff. You also gain access to experienced professionals who can handle everything from payroll processing to account reconciliation and financial reporting.

Accounting And Bookkeeping Services

At Gnesist, our Accounting And Bookkeeping Services deliver clear, accurate financial records so you can focus on growing your business. Our dedicated team acts as your virtual bookkeeper, ensuring every transaction is captured and categorized correctly. We offer:

This comprehensive guide explores everything you need to know about remote bookkeeping services in 2025. You’ll learn how these online bookkeeping solutions work, what features to look for, and basic cost comparisons. The cost of remote services vs. in-house is important for setting up a successful partnership with a virtual bookkeeper. We’ll also address common challenges of remote bookkeeping and how to overcome them. This allows you to better embrace a more efficient way to manage your finances.

What Are Remote Bookkeeping Services and How Do They Work in 2025?

In today’s digital business environment, managing financial records has evolved significantly. Remote bookkeeping services represent a fundamental shift in how companies handle their finances – offering flexibility and efficiency that traditional methods can’t match. Online bookkeeping firms have become increasingly popular, providing a range of services tailored to meet the needs of modern businesses. Even small companies now turn to outsourced bookkeeping and accounting services to leverage expert help without the overhead of full-time staff.

Definition and Core Functions of Remote Bookkeeping

Remote bookkeeping is the process of managing a business’s financial records and transactions from a distance using 【19†cloud-based accounting software】. Unlike traditional in-office bookkeeping, a remote bookkeeper performs all essential accounting and bookkeeping tasks virtually, without needing to be physically present at your location. This approach to outsourced bookkeeping has rapidly gained traction among businesses of all sizes, particularly in the realm of small business accounting. In many cases, virtual bookkeeping services are simply an extension of your team via the internet.

Core functions of remote bookkeeping services include:

- Recording and organizing all financial transactions

- Reconciling bank statements and accounts

- Managing payroll operations

- Preparing comprehensive financial reports

- Assisting with budgeting and financial planning

- Handling invoicing and monitoring bill payments

- Identifying and correcting financial errors

A virtual bookkeeper utilizes secure online applications to track your financial data through cloud platforms, ensuring your information stays current. They provide accurate monthly financial statements and reports for critical decision-making. Research even indicates that businesses using cloud-based accounting are more likely to experience a 15% year-over-year growth in revenue. All thanks to real-time insights and efficiency gains. In short, online bookkeeping services for small business cover all the same bases as an in-house bookkeeper—just delivered remotely via technology.

How Online Bookkeeping Services Work (The Remote Bookkeeping Process Explained)

The remote bookkeeping process in 2025 typically begins with granting your bookkeeper secure access to your financial data. This occurs through encrypted cloud-based accounting platforms where both you and the bookkeeper can view and update information in real time. The remote bookkeeper will first review your company’s historical records to assess the current state of your books and identify any gaps or issues that need attention.

Next, the remote bookkeeper will generally:

- Clarify your specific requirements (e.g. monthly reports, expense tracking, tax preparation).

- Analyze incoming and outgoing funds to accurately record your business’s cash flow.

- Develop action plans or schedules based on your needs (for instance, a monthly closing checklist).

- Prepare detailed financial reports with recommendations on your financial position.

- Deliver these reports and insights at predetermined intervals (monthly, quarterly, etc.).

Top accounting solutions Used By Accounting Firms

Modern remote bookkeepers leverage sophisticated software to streamline each step. Nearly 94% of accounting professionals now rely on cloud accounting solutions. They utilize platforms like QuickBooks Online, Xero, and FreshBooks. These tools offer essential features such as invoicing, expense tracking, payroll processing, and real-time financial reporting. By using cloud-based systems, your virtual bookkeeper ensures that you always have up-to-date financial data at your fingertips. Robust security measures—like data encryption, secure access protocols, and two-factor authentication—keep your sensitive information safe even as it’s accessed remotely. In fact, today’s cloud accounting solutions are often more secure than traditional on-site storage, due to automatic backups and enterprise-grade cybersecurity.

Technology continues to drive remote bookkeeping forward. Automation and AI now handle many routine tasks (data entry, transaction categorization, reconciliations), allowing remote bookkeepers to focus on delivering strategic insights and ensuring compliance with complex regulations. For example, over 120,000 small and midsize businesses use BILL (formerly Bill.com) to automate payables and receivables, collectively processing more than $140 billion in payments annually. Through this streamlined, software-driven process, remote accounting services can deliver accurate, timely financial information that helps you make informed decisions—all without the overhead costs of traditional in-house bookkeeping.

According to industry surveys, roughly 37% of small businesses now outsource their accounting or bookkeeping tasks, and this share is projected to surpass 50% by 2034. This upward trend underscores the growing trust in virtual bookkeeping and accounting services. The chart below illustrates the rise in remote bookkeeping adoption among companies.

Figure: Rising Adoption of Remote Bookkeeping. Approximately 37% of small businesses outsourced bookkeeping or accounting in 2024, and experts predict over 50% will do so by 2034. This trend highlights how rapidly companies are embracing online bookkeeping solutions to cut costs and improve efficiency.

Essential Features to Look for in Remote Bookkeeping Services

When selecting a provider to manage your finances remotely, certain features can make or break your experience. Choosing the right remote bookkeeping services requires careful evaluation of multiple factors that directly impact your operations and financial health. In this section, we outline key features to prioritize as you vet virtual bookkeeping and accounting services.

Software Compatibility and Integration Capabilities

Effective remote bookkeeping relies heavily on cloud-based accounting software that can seamlessly integrate with your existing business systems. With most accountants embracing cloud technology, it’s crucial that your remote bookkeeper works with the tools you already use. Make sure any service you consider is compatible with popular accounting platforms like QuickBooks, Xero, Sage, or Zoho Books (whichever you use or plan to use). 94% of accountants have experience using these top 5 accounting solutions. This means most accounting firms will be fluent in these systems and possibly offer their own cloud portal for you.

Key software integration features to look for include:

- Real-time synchronization between the bookkeeping software and your other systems (such as e-commerce, CRM, or POS systems).

- Compatibility with your current accounting software and file formats, so data transfers are smooth.

- Multi-currency support if your business operates globally, to handle international transactions.

- Automated workflows between applications (for example, automatically importing sales data into accounting records).

- Mobile accessibility, allowing you to review financial data and reports on the go via a smartphone app.

The right integration capabilities eliminate data silos and reduce manual data entry errors. Essentially, your remote bookkeeper should work with tools that plug into your business ecosystem, creating a unified financial management system. This ensures your online bookkeeping services dovetail with your operations rather than causing disruption.

Security Protocols and Data Protection

Given that a remote bookkeeper will handle sensitive financial information, robust security measures are non-negotiable. In recent years there have been a few high-profile breaches in the accounting industry – for example, ransomware attacks at MNP in Canada that affected 80 offices, and a breach at BST & Co. where client financial data was compromised. These incidents underscore why security is paramount when outsourcing bookkeeping or accounting services.

Reputable remote bookkeeping services implement several critical security protocols:

- End-to-end encryption for data in transit and at rest, so your financial data is always encrypted (scrambled to outsiders).

- Multi-factor authentication (MFA) for all login access, adding an extra verification step beyond just a password.

- Regular security audits and penetration testing to identify and patch vulnerabilities in their systems.

- Role-based access controls, ensuring staff only see the data necessary for their role.

- Comprehensive backups and disaster recovery plans, with frequent backups of your data and clear processes to restore it if needed.

Many leading providers comply with standards like ISO 27001, which includes 114 security controls covering people, processes, and technology. Before engaging any online bookkeeping services, verify their commitment to data protection and regulatory compliance (for instance, adherence to GDPR if applicable, or SOC 2 certification). Remember – you’re trusting them with your books, so their security practices should be solid.

Communication Systems and Responsiveness

Effective communication is the foundation of a successful remote bookkeeping relationship. Since you won’t see your bookkeeper in person, you need clear channels for sharing information and getting answers quickly. The best virtual bookkeeping providers establish multiple communication methods to stay connected with their clients.

When evaluating a remote bookkeeping service’s communication, consider the following:

- Do they offer a dedicated client portal or secure document exchange system for sharing receipts, statements, and reports?

- What are their guaranteed response times for questions or requests? Top providers will respond within 24 hours or faster for urgent matters.

- Will you have regular check-in meetings (weekly, biweekly, or monthly) to review financial results and open items?

- Are there real-time chat options (via Slack, Teams, or similar) for quick questions during the workday?

- Do they accommodate video conferences for more in-depth discussions or quarterly reviews of your financials?

In our increasingly digital workplace, tools like Zoom or Microsoft Teams have become essential for building rapport and trust remotely. You should feel comfortable communicating with your bookkeeper as if they were in-house. Clear, agreed-upon “rules of engagement” (for example, what’s considered an urgent issue versus something that can wait) will help set the right expectations on both sides. Ultimately, a remote bookkeeping service should be highly responsive and available through your preferred channels—be it email, phone, chat, or video.

Reporting Capabilities and Customization Options

The value of online bookkeeping services for small business extends beyond basic transaction recording. Quality providers deliver insightful financial reports that drive better decision-making for your company. When vetting a remote bookkeeper, pay attention to the depth and flexibility of their reporting capabilities.

Key reporting features to look for include:

- Customizable dashboards where you can view key financial metrics at a glance, tailored to what matters most for your business.

- Real-time reporting so you don’t have to wait until month-end to see your cash flow or profit numbers.

- Industry-specific reports, if applicable – for example, tracking billable hours for a consulting firm or inventory turnover for a retailer.

- Cash flow analysis and forecasting tools, helping you manage liquidity and plan for upcoming expenses.

- KPI tracking aligned with your business goals (e.g. gross margin, current ratio, customer acquisition cost) and the ability to create custom reports on those.

Beyond standard profit-and-loss statements and balance sheets, consider whether a provider can generate specialized reports that you might need. Studies show that businesses with access to customized financial reporting make more informed decisions and often see better financial outcomes. For instance, having a tailored report on job profitability could help a construction company bid more effectively. The ideal remote bookkeeper will offer a combination of robust standard reports and the flexibility to customize or drill down into the data as you require.

Throughout your selection process, keep in mind that the best remote bookkeeping services combine technological sophistication, rigorous security, clear communication, and flexible reporting options aligned to your specific needs. If a provider checks all these boxes, you’ll be well on your way to a productive partnership.

Comparing Costs: Remote Bookkeeping Services vs. In-House Bookkeeping

Making smart financial decisions is at the heart of successful business management – especially when it comes to handling your books. One major decision is whether to keep bookkeeping in-house or to use a remote service. The choice between an in-house bookkeeper and a remote bookkeeping service can significantly impact your bottom line. Let’s break down the cost implications of each approach, going beyond the surface to see the true costs and savings.

Try Gnesist Bookkeeping Services For Accurate and Reliable Bookkeeping!

Accounting And Bookkeeping Services

At Gnesist, our Accounting And Bookkeeping Services deliver clear, accurate financial records so you can focus on growing your business. Our dedicated team acts as your virtual bookkeeper, ensuring every transaction is captured and categorized correctly. We offer:

Breaking Down the True Cost of Remote Bookkeeping Services

At first glance, the pricing structure for remote bookkeeping services might range widely – typically from around $500 up to $7,500 per month for large or complex businesses. For a smaller company with straightforward finances, basic remote bookkeeping packages start around $190 per month, while mid-tier services with more support range from roughly $299 to $500 monthly. Full-service options that include advanced reporting and CFO-level guidance can climb to $1,000–$2,500 per month for growing enterprises. These figures may seem substantial, but they require context for a meaningful comparison to in-house costs.

Remote bookkeeping providers typically price their services based on a few factors:

- Transaction volume and complexity – higher transaction counts or more complex accounting (multiple revenue streams, etc.) will cost more.

- Number of accounts or entities managed – e.g. multiple bank accounts, credit cards, or business entities.

- Frequency of reporting – weekly reporting and close support might cost more than monthly reporting.

- Additional services like payroll processing, tax preparation, or bill pay – often available à la carte or in higher-tier plans.

Price Comparison Between Firms

For example, QuickBooks Live (Intuit’s own bookkeeping service) starts at around $35 per month for basic assistance, whereas a more comprehensive service like Pilot may begin at $699 per month for startups. This variability means you can scale remote services up or down to fit your budget and needs – a flexibility that fixed in-house staffing can’t easily match.

For a small business, maintaining a full-time in-house bookkeeper can easily cost around $60,000 per year (once you include salary, benefits, and overhead), whereas utilizing remote bookkeeping services may only cost roughly $10,000 per year. That’s an 83% reduction in bookkeeping costs. The chart below illustrates this dramatic cost difference between an in-house hire and an online bookkeeping service for a typical small business.

Figure: Annual Cost – In-House vs Remote Bookkeeping. Hiring a full-time bookkeeper in-house (salary + benefits + overhead) might cost ~$60k/year, while a comparable remote bookkeeping service could be ~$10k/year. This represents over 80% cost savings by opting for virtual bookkeeping. Such savings can significantly improve a small business’s bottom line.

Hidden Savings Beyond the Monthly Fee

The cost gap becomes even more pronounced when you examine the total expenses of in-house bookkeeping versus remote. A full-time in-house bookkeeper commands an average salary of around $40,000 per year, while a staff accountant might average $57,000 and an accounting manager or controller can be $80,000–$105,000 or more annually. But the salary is just the beginning.

Don’t forget the additional costs of having an employee:

- Employee benefits (health insurance, retirement, etc.) which add roughly 20–30% on top of salary – about $10,000–$15,000 extra for a $50k salary.

- Office space and utilities, which could cost $5,000–$20,000 annually for the portion of an office used by that employee (especially in high-rent areas).

- Technology and software expenses, including computers, software licenses, and IT support – easily $5,000–$10,000 per year for professional accounting software and equipment.

- Training and development to keep skills up to date (e.g. courses on the latest accounting standards) – perhaps $1,000–$3,000 yearly.

- Recruitment and turnover costs if your bookkeeper leaves – advertising the job, interviewing, onboarding a replacement – this time and expense can be significant and is often overlooked.

In comparison, outsourcing to a remote bookkeeping service eliminates all of these overhead costs. The virtual bookkeeping company handles their own office space, utilities, software, and staff training. As a result, businesses can reduce administrative and overhead expenses by approximately 40% through remote options. Moreover, using an outsourced service converts many fixed costs into variable costs. You pay only for the level of service you need, when you need it. If your bookkeeping needs decrease in the slow season, you might move to a lower plan or incur fewer hours – something that’s not possible with a full-time salaried employee.

This scalability especially benefits businesses with seasonal swings or high growth. During busy periods you can scale up service (at an incremental cost), and scale down during lulls. In essence, remote bookkeeping services let you “pay as you go” rather than committing to a large fixed salary and overhead, freeing up cash for other parts of your business.

When Premium Services Are Worth the Investment

While basic online bookkeeping services for small business might suffice initially, there are compelling reasons to consider premium tiers as your operation expands. Higher-tier remote bookkeeping services typically include features and expertise that can deliver substantial long-term value, offsetting their higher fees.

Upgrading to a premium service becomes worthwhile when you need specialized knowledge that would otherwise require hiring additional in-house professionals. For instance, some bookkeeping services include tax compliance and planning guidance from certified public accountants. This can save businesses an average of $12,000 annually in taxes by optimizing deductions and ensuring compliance – a significant ROI on the service cost. Similarly, premium packages may provide CFO-level analysis, budgeting assistance, and financial forecasting. These advanced insights help you make better strategic decisions. Companies that leverage such expert guidance often see improved financial outcomes over time.

In short, you should weigh not just the cost, but the value delivered. A value-based approach to selecting bookkeeping services often yields better results than a purely cost-driven decision. Rather than focusing solely on the monthly fee, consider the potential return on investment through improved financial management, reduced errors, time savings, and strategic advice that drives profitability. If a premium service helps you avoid a costly mistake (like a compliance penalty) or identifies a growth opportunity in your financials, it effectively pays for itself.

For many businesses, the optimal solution is a balanced approach: start with an affordable package to get the essentials in place, then scale up the service level as your needs become more complex. This way, your bookkeeping solution evolves alongside your business—providing the right expertise at the right time, and always delivering more benefit than it costs.

Setting Up a Successful Partnership with Your Remote Bookkeeper

Forging a productive partnership with your remote bookkeeper requires deliberate planning and clear boundaries. Even though you’re not in the same location, you can work together seamlessly by establishing the right processes from the start. Here are some best practices for collaborating effectively with an online bookkeeping services provider or remote bookkeeper.

Establishing Clear Expectations and Workflows

The foundation of any successful remote bookkeeping relationship is clarity about responsibilities and deliverables. Before any work begins, outline specific expectations: what services you need, what outputs you expect, and on what schedule. For example, do you require weekly cash flow updates or just monthly financial statements? Who will categorize transactions or address discrepancies? By clearly defining the scope, you ensure your bookkeeper focuses on the bookkeeping services your small business truly needs.

It can be helpful to create a responsibilities checklist for both parties. List out tasks that you will handle (e.g. approving bills, making bank deposits) and tasks the bookkeeper will handle (reconciling accounts, preparing reports). This document serves as a mutual agreement and prevents confusion over who does what. Similarly, establish realistic timelines for recurring processes, especially if multiple people are involved on your side. For instance, if the bookkeeper needs certain information by the 5th of each month, ensure your team knows that deadline. Clear workflows and turnaround times set everyone up for success and keep your virtual bookkeeping partnership running smoothly.

Creating Effective Communication Channels

Communication is the backbone of any remote working relationship. To keep in sync with your bookkeeper despite not sharing an office, you’ll want to be intentional about how and when you communicate. Here are a few tips:

Schedule regular check-ins

- Set up a recurring meeting (weekly, biweekly, or monthly) to go over your financial status, ask questions, and review deliverables. Regular touchpoints help catch issues early and keep both sides accountable.

Use multiple channels

- Rely on more than just email. Email is great for formal reports, but day-to-day you might use an instant messaging tool (like Slack or Microsoft Teams) for quick questions and updates. Some businesses also use project management tools to assign and track finance-related tasks.

Dedicated discussion channels

- If using a chat app, create channels or threads for different topics – e.g. one for general updates or questions, another for urgent issues, another for sharing documents. This keeps communication organized.

Establish response expectations

- Be clear about typical response times. For example, agree that emails will be answered within one business day, and truly urgent matters will get a response within an hour. Likewise, let your bookkeeper know your expected turnaround on requests they make of you.

Mind the time zones

- If you and your remote bookkeeper are in different time zones, identify a window of overlapping work hours for real-time communication. Schedule meetings during those windows, and be understanding of any delayed responses outside of them.

Business professionals often recommend going beyond email because important messages can get lost in a crowded inbox. Consider using a shared folder or portal for financial documents, and even a dedicated phone or video call schedule for more personal interaction. By setting up multiple, well-defined communication channels, you’ll build a strong working relationship. Remember, as one accounting firm put it, “there is no substitute for good communication, especially when it comes to your finances.”

Sharing Access and Maintaining Security

When working with online bookkeeping services for small business, security should always be top of mind. You’ll need to share access to financial accounts and data, but it must be done safely. Start by providing your bookkeeper with their own login credentials for any accounts they need to access (bank accounts, accounting software, payment processors). Do not simply share your personal usernames and passwords – not only is that risky, it may violate your bank’s terms of service. Most banks and financial platforms allow adding an authorized user or accountant access with limited permissions.

Using a password manager can simplify this process. Tools like LastPass or 1Password allow you to share credentials securely without revealing the password itself. For example, you can grant your bookkeeper access to your QuickBooks or Xero file through the software’s user management, and share any necessary passwords (like to your payroll provider) via an encrypted password manager link. This way, sensitive login information isn’t being sent over email or chat.

Above all, utilize your cloud accounting software’s collaboration features. Platforms like QuickBooks Online, Wave, or Zoho Books let you invite your bookkeeper as a user on your account. You retain control over what they can see or do (for instance, view-only versus allowing them to create transactions). This approach creates an audit trail of every action taken, clearly attributing activities to either you or the bookkeeper. It builds trust, because you can always review who did what in the system. By taking these steps — separate logins, proper permissions, and secure sharing tools — you maintain security and accountability while giving your remote bookkeeper the access they need to do their job.

Common Challenges of Remote Bookkeeping Services and How to Overcome Them

Despite the many advantages of remote bookkeeping, businesses may encounter some challenges when making the switch to a virtual arrangement. Knowing these potential issues in advance – and having a plan to overcome them – will ensure your remote bookkeeping services engagement remains smooth and successful. Let’s look at a few common challenges and strategies to address them.

Managing the Transition from Traditional Bookkeeping

Shifting from an in-person bookkeeper (or doing it yourself) to a virtual bookkeeping service can be an adjustment. Business owners and internal teams might experience initial confusion as processes change. To smooth this transition:

- Document your current processes before the handoff. Write down how invoices are currently approved, how receipts are stored, what reports are generated, etc. This gives the remote bookkeeper a blueprint of your operations so they can align with it or improve it.

- Implement a phased transition. You don’t have to shift everything in one day. Perhaps start by letting the remote bookkeeper handle a simpler task (like monthly reconciliations) while you retain more complex tasks short-term, then gradually hand off more as they gain familiarity.

- Train your team on new tools. If switching to a new accounting software or portal as part of going remote, ensure anyone in your company who interacts with the finances gets a basic orientation. A quick training session or how-to guide can bridge knowledge gaps and reduce mistakes.

It’s also important to set a positive tone about the change. Emphasize the benefits of virtual bookkeeping – such as cost savings and improved efficiency – to get buy-in from your staff. Most teams adapt quickly once they see the streamlined results. By planning the onboarding process and communicating clearly, you can transition to an online bookkeeping system with minimal disruption.

Ensuring Data Security and Privacy

Security is a top concern whenever financial data is accessed outside your office. Recent incidents reinforce why vigilance is needed. For example, a major breach at an accounting firm exposed data of 217,000 users, underscoring that even professionals are not immune to cyber threats. To protect your information when working with a remote bookkeeper:

- Require strong encryption (256-bit SSL/TLS or better) for any cloud portals or file transfers. Essentially, any data transmitted between you and the bookkeeper should be encrypted.

- Use multi-factor authentication (MFA) on all financial accounts and software. This means even if a password is compromised, a second factor (like a code on your phone) is needed to log in.

- Implement role-based permissions in your software to limit what the bookkeeper can access. For instance, maybe they can view your bank transactions but not initiate payments. Adjust permissions to the minimum necessary for their work.

- Conduct regular security audits. Periodically review who has access to what, and ensure the bookkeeper’s access rights are up to date. Also ask about your provider’s own security audits – reputable firms will routinely test their defenses and have security certifications (like ISO 27001 compliance).

By taking these steps, along with the secure access practices mentioned earlier, you greatly reduce the risk of a data breach. Reputable online bookkeeping services will often have you sign a confidentiality agreement as well, to formalize their obligation to protect your data. Don’t hesitate to discuss security concerns with your provider – they should be able to explain how they keep client data safe.

Maintaining Effective Communication

Without physical proximity, communication requires a bit more effort and structure. Miscommunication or radio silence can quickly derail a remote bookkeeping arrangement. As the saying goes, there’s no such thing as over-communicating in this context. Both you and your bookkeeper should be proactive about keeping each other informed.

To overcome this challenge, establish communication norms upfront (as discussed earlier). Set expectations around response times so you’re not left wondering if your message was seen. Schedule regular video or phone meetings – face-to-face interaction, even via video, builds rapport and clears up issues faster than back-and-forth emails. You can also use project management or tracking tools to assign tasks with due dates, so everyone can see the status of open items.

It may help to create dedicated communication channels for bookkeeping topics. For example, have a specific email thread or Slack channel just for finance matters. This way, nothing gets lost among unrelated messages. Encourage your bookkeeper to ask questions and clarify assumptions; as a client, remain approachable. Remember, the goal is the same for both parties: accurate, up-to-date books. Keeping the lines of communication open – and scheduling touchpoints on the calendar – ensures that happens consistently.

Handling Time Zone Differences

If your remote bookkeeper is in a different city or country, time zone differences can introduce delays if not managed well. For instance, if you’re in New York and your bookkeeper is in London, your business day only overlaps a few hours with theirs. This can slow down interactions if you need real-time answers or have urgent requests.

To tackle this, identify the overlapping working hours you do share and plan important live communications during that window. For matters that can wait, communicate in writing so the other person can respond when their day begins. Some companies with significant time zone gaps set up split schedules – e.g. the bookkeeper might adjust their hours slightly earlier or later, and someone on your team might come in earlier, to extend the overlap. Additionally, use scheduling tools or world clock apps to avoid confusion about meeting times.

It’s also important to be respectful of each other’s local work hours. If it’s midnight for your bookkeeper, you shouldn’t expect an immediate reply – and vice versa. By setting clear expectations about availability and maybe agreeing on an “emergency” contact plan for true off-hours urgencies, you can mitigate most time zone challenges. Many businesses actually turn time differences into a positive: work can continue nearly around the clock, with the bookkeeper updating books after your day ends, so you start the next day with fresh financial reports.

Dealing with Software Compatibility Issues

Sometimes a business’s existing software doesn’t perfectly mesh with the bookkeeper’s systems. Integration hiccups or compatibility issues can be frustrating – for example, your POS system might not export data in a format that imports neatly into the accounting software. Studies indicate that incompatibility between accounting software and other business tools is a top frustration for companies adopting new financial tech.

To avoid this, do a thorough tech assessment at the start. Identify all the software that will be involved (bank feeds, invoicing tools, payroll platforms, etc.) and ensure your remote bookkeeper is familiar with them or has a plan to integrate them. They might use middleware or third-party connectors to link systems that don’t natively talk to each other. It’s wise to select a bookkeeping service that is flexible and tech-savvy – they should be able to recommend solutions, like an API-based integration or even a simple workaround (for instance, using CSV file uploads if direct sync is not available).

Implementing gradual software updates can also help. If you need to transition to a new accounting system, do it in stages rather than all at once. This gives time to resolve any compatibility issues on a smaller scale before they affect your whole operation. The key is open dialogue: let your bookkeeper know all the tools you rely on, and ask how they will ensure everything interfaces correctly. A little planning prevents a lot of headache when it comes to software compatibility.

By addressing these common challenges proactively, you can fully realize the benefits of remote bookkeeping services while minimizing potential disruptions. In most cases, the solutions are straightforward – and the cost savings and efficiency gains of virtual bookkeeping far outweigh the initial hurdles.

Conclusion

Remote bookkeeping services offer significant advantages for modern businesses, especially through major cost savings and ready access to expert financial support. While a traditional in-house bookkeeping setup can strain resources, remote accounting services provide flexibility and scalability at a fraction of the cost. Beyond savings, businesses benefit from the breadth of knowledge that online bookkeepers bring – you tap into professionals who have experience across industries and can elevate your financial management practices.

Accounting & Bookkeeping Software

Technology advancements have made remote bookkeeping simpler, faster, and more secure than ever. Cloud-based software ensures that you and your bookkeeper are always looking at the same up-to-date data, no matter where you are. Strict security protocols (encryption, MFA, secure portals) keep your financial information protected while still accessible to authorized users. Additionally, automation tools now handle many tedious bookkeeping tasks behind the scenes. This means your remote bookkeeper can focus on delivering expert financial management insights rather than getting bogged down in manual data entry. In short, online bookkeeping and virtual bookkeeping solutions let you enjoy accurate, real-time financial reporting without hiring a full in-house team.

Of course, no arrangement is without challenges. Working remotely requires establishing clear communication channels and workflows, as we discussed. However, with a bit of upfront effort, these challenges are easily overcome. Companies that prioritize regular check-ins, shared tools, and defined expectations quickly find that distance is not a barrier at all. The key is choosing the right partner and setting up the proper systems from the start. Smart businesses recognize that effective financial management – remote or otherwise – is the backbone of success, and they plan accordingly.

Boosting Company Efficiency

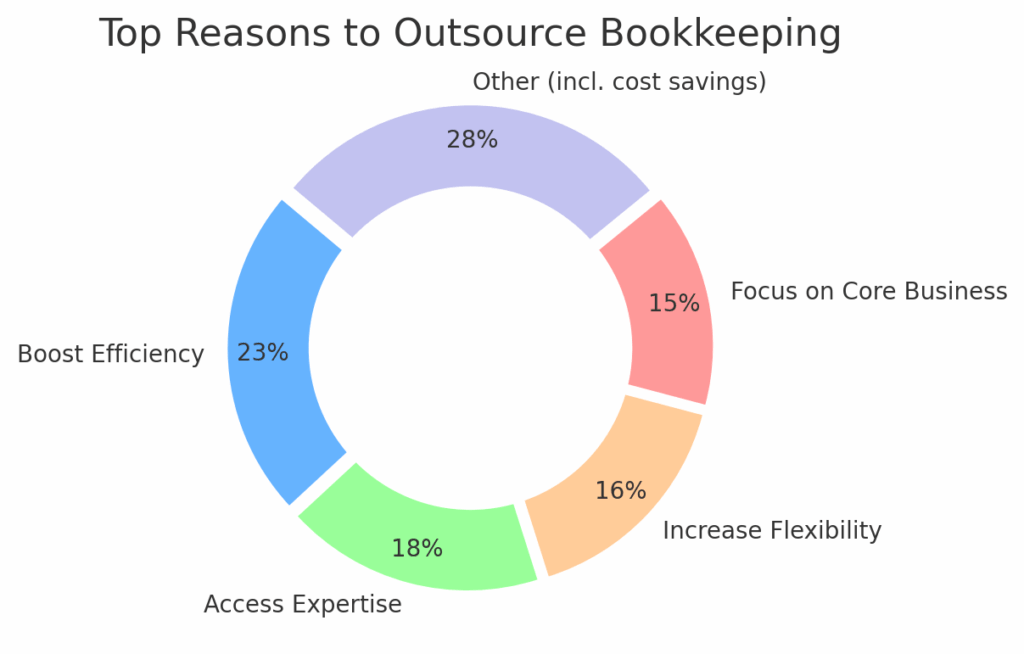

Many companies are turning to remote bookkeeping not just for cost reduction, but for strategic advantages. In fact, nearly a quarter of small businesses that outsource bookkeeping cite boosting efficiency as the primary reason, while others prioritize access to expertise (18%), greater flexibility (16%), and freeing up time to focus on core business tasks (15%). The chart below highlights these top motivations for adopting online bookkeeping services (with cost savings accounting for much of the remaining 28% categorized as “Other”).

Figure: Top Reasons Businesses Outsource Bookkeeping – aside from cost savings. Improving efficiency is the #1 driver (~23% of businesses), followed by accessing expert skills (18%), increasing flexibility (16%), and refocusing staff on core business (15%). (“Other”, 28%, includes cost savings and various other reasons.)

Ready to transform your financial management for the better? Gnesist’s Online Bookkeeping Services deliver secure, reliable virtual bookkeeping tailored to your business. By partnering with our team, you’ll ensure accuracy and compliance while saving valuable time and money in the long run.

Remember, outsourcing your bookkeeping doesn’t mean losing control – it means gaining an expert ally. With qualified remote bookkeepers handling your books with precision and care, you’re free to focus on growing your business. Whether you need assistance with accounts payable and receivable, payroll, bank reconciliations, or preparing accurate financial statements, a dedicated remote bookkeeper can provide the support your business needs to thrive in today’s competitive landscape. Embrace the future of remote bookkeeping services and enjoy peace of mind knowing your finances are in expert hands.

Accounting And Bookkeeping Services

At Gnesist, our Accounting And Bookkeeping Services deliver clear, accurate financial records so you can focus on growing your business. Our dedicated team acts as your virtual bookkeeper, ensuring every…