Simple Guide on the Difference Between Bookkeeping and Accounting

Many business owners feel confused when it comes to handling their finances. They often wonder whether they need a bookkeeper vs accountant, or which tasks belong to bookkeeping vs accounting. In simple terms, The Difference Between Bookkeeping and Accounting comes down to how each professional handles financial information. Bookkeepers record it. Accountants analyze it.

If you learn The Difference Between Bookkeeping and Accounting, you can make better financial choices for your company. In this guide, we’ll explore which tasks each role covers, the skills they need, and the best time to hire each one. We’ll also show you how understanding accounting vs bookkeeping can support your business at each growth stage.

Bookkeeping Tasks

Bookkeeping involves tracking your day-to-day transactions. A bookkeeper monitors how much money comes in and goes out. By doing so, you get an accurate picture of your finances. Here are some common tasks a bookkeeper handles:

- Recording daily income and expenses

- Reconciling bank statements

- Managing invoices and payments

- Keeping organized financial records

Many small business owners handle their own bookkeeping at first. They might use simple spreadsheets or inexpensive software. But as their business grows, these tasks can become time-consuming. That’s when outsourcing or hiring help can free up time for more strategic work.

Accounting Tasks

Accounting builds on the data created by bookkeeping. Accountants look at the numbers and figure out what they mean for your business. Their tasks often include:

- Preparing financial statements

- Offering tax advice and filing returns

- Finding ways to reduce costs and improve profits

- Analyzing trends and forecasting revenue

In the bookkeeper vs accountant debate, each role adds value in different ways. A bookkeeper ensures your records are accurate and up to date. An accountant uses those records to guide important financial decisions. When you explore accounting vs bookkeeping, you’ll notice that accountants often hold degrees or professional certifications, such as a CPA. This extra training helps them tackle more complex financial tasks.

The Difference Between Bookkeeping and Accounting in Daily Operations

So, what is the difference between accountant and bookkeeper? Think of it this way:

- Bookkeepers track the money, making sure numbers are correct and accounts are balanced.

- Accountants study these numbers to plan for taxes, growth, and future goals.

In daily operations, you might only need basic bookkeeping at first. As your business grows, you may need professional accounting for strategic planning. This shift often happens when finances become more complex, or if you need deeper analysis to improve cash flow or secure funding.

When to Hire a Bookkeeper

Hiring a bookkeeper makes sense if:

- You have limited financial transactions.

- Your budget for finance-related tasks is tight.

- You can do some work yourself and just need help with the rest.

Plenty of owners handle basic bookkeeping on their own. But if you spend too much time on tasks like data entry or bank reconciliations, it might be wise to hire help. A bookkeeper can keep your records tidy so you can focus on running your business.

When to Hire an Accountant

An accountant is vital when:

- You need advanced tax planning and filings.

- You want to explore new business strategies or expansions.

- Your company has outgrown simple bookkeeping systems.

A skilled accountant can find tax breaks you didn’t realize were possible. They can also see money patterns and plan for the long term. This guidance helps you make wise decisions about spending, investments, and growth. Understanding bookkeeping vs accounting can save you from costly errors down the road.

Combining Bookkeeping and Accounting

Most companies need both services at some point. You can start with a bookkeeper who keeps your records accurate. Then, bring in an accountant to offer insights based on those records. Over time, you might hire a full-time finance team or continue to outsource. The path you choose depends on your budget, business stage, and how fast you’re growing.

In many cases, you’ll work with both a bookkeeper and an accountant side by side. The bookkeeper ensures daily tasks are accurate, while the accountant interprets the data. This blend of services covers both the difference between accountant and bookkeeper and shows you how each function drives success.

Building a Long-Term Financial Plan

As your business grows, you might face new challenges. You may need extra tools and expertise to manage these changes. Here’s how to plan for the future:

- Start Simple: Use basic bookkeeping tools to track revenue and expenses. Keep things organized from day one.

- Add Expertise: Hire a part-time or freelance bookkeeper if the workload becomes too big. Consider an accountant when tax rules or strategy questions pop up.

- Upgrade Software: Move to advanced accounting software when you handle more transactions and need detailed reports.

- Go Full-Time: If you reach a certain size, having a full-time finance team makes sense. This can include both a bookkeeper and an accountant.

Following these steps helps you avoid chaos while still reaping the benefits of each role. By staying organized, you’ll keep your company stable and make better moves as you grow.

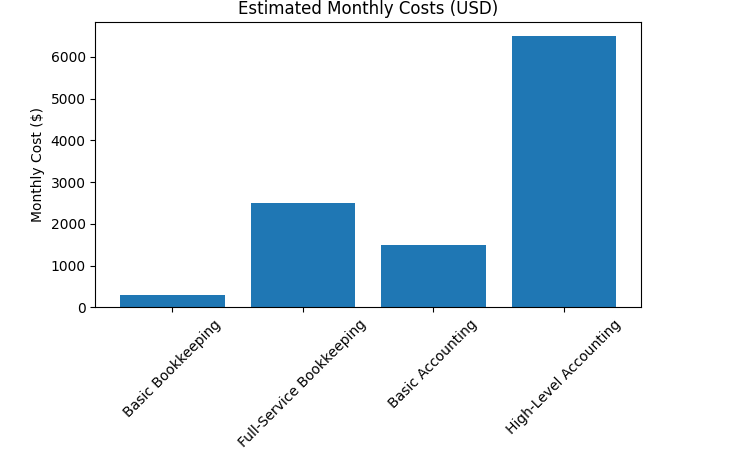

How much does an accountant or bookkeeper cost

Recent pricing trends show a shift toward flexible and bundled service packages. Many freelance bookkeepers and accounting companies now offer monthly plans based on how big your business is or how many transactions you have, instead of only charging by the hour. For example, some online bookkeeping services charge a set monthly fee between $300 and $700, depending on how much your business spends each month.

How Much Does a Bookkeeper Cost?

Freelance bookkeepers in the U.S. usually charge between $40 and $100 per hour, with the average being around $70. Small businesses often pay closer to the lower end of that range, while bigger or more complicated businesses pay more. Most bookkeeping is billed by the hour, but some bookkeepers offer a flat monthly fee so costs are easier to predict. For part-time help, small businesses might pay about $200 to over $1,000 each month. On average, monthly bookkeeping services package cost between $500 and $2,500, depending on how many transactions there are and what services are included. These services usually include things like sending invoices, paying bills, tracking expenses, and checking bank statements.

How Much Does an Accountant Cost?

CPA accountants who help small businesses usually charge more per hour, with average rates between $150 and $400. Newer or less experienced accountants might charge less, around $50 to $150 an hour for basic accounting services. But highly experienced CPAs with special skills can charge up to $1,000 an hour for complex advice.

Unlike bookkeepers, accountants are usually hired for special projects or advice a few times a year, not for daily work. Many small businesses use accountants for important accounting tasks like doing taxes, creating financial reports, and giving expert advice. Just filing taxes can cost between $500 and over $2,000 depending on how complicated it is. Instead of paying every month, small businesses usually pay for accounting once a year or every few months. On average, they spend between $1,500 and $6,500 each year. This usually covers help with taxes, end-of-year reports, and occasional financial guidance.

Bookkeep With Gnesist!

Accounting And Bookkeeping Services

At Gnesist, our Accounting And Bookkeeping Services deliver clear, accurate financial records so you can focus on growing your business. Our dedicated team acts as your virtual bookkeeper, ensuring every…

Final Thoughts on The Difference Between Bookkeeping and Accounting

The Difference Between Bookkeeping and Accounting can shape your financial future. Bookkeepers handle the daily nuts and bolts, while accountants guide big-picture decisions. Learning accounting vs bookkeeping will help you decide which services to invest in and when. This knowledge is also key when you compare bookkeeper vs accountant options.

Above all, remember that The Difference Between Bookkeeping and Accounting does not mean you have to choose one over the other forever. Both roles support you at different stages. By knowing when to use each service, you’ll keep your business on the right financial path. Whether you explore bookkeeping vs accounting on your own or hire pros, this insight prepares you for any stage of growth.

If you’re still unsure about the difference between accountant and bookkeeper, think about what your business needs today. Then, plan ahead for more advanced help tomorrow. With the right mix of record-keeping and financial advice, you’ll set the stage for long-term success.