Benefits of Virtual Bookkeeping And Why Its Good For Growth

Ninety-nine percent of business owners don’t enjoy managing their books – and chances are, you’re one of them. The benefits of virtual bookkeeping extend far beyond simply keeping your financial records in order.

Rather than spending valuable time wrestling with spreadsheets or paying for a full-time in-house bookkeeper’s salary and benefits, online bookkeeping services for small businesses offer a more cost-effective solution. In fact, these virtual accounting services provide real-time access to financial data while eliminating overhead costs, as you only pay for the services you actually need.

This comprehensive guide explores why small businesses are increasingly switching to virtual bookkeeping, the hidden advantages you might not have considered, and how this modern approach to financial management could transform your business operations.

Understanding How A Virtual Bookkeeping Services Can Help Small Businesses

Virtual bookkeeping represents a significant shift in how businesses manage their finances. Instead of maintaining an in-house bookkeeper, companies can now access professional financial services remotely through the internet and digital platforms. But what exactly is virtual bookkeeping?

What does a virtual bookkeeper do?

A virtual bookkeeper performs essentially the same functions as a traditional on-site bookkeeper but operates remotely using cloud-based accounting software. Their core responsibilities include:

- Managing financial records and documenting transactions

- Overseeing accounts payable and accounts receivable

- Handling invoicing and calculating business profits

- Reconciling bank and credit card accounts

- Processing payroll services when needed

- Maintaining general ledger accounts

The primary difference lies in their work location. Instead of coming to your office, virtual bookkeepers leverage technology to perform these tasks from anywhere with reliable internet connectivity. They communicate through emails, video calls, or messaging platforms while accessing your financial data through secure, encrypted software like QuickBooks or Xero.

Ditch the DIY Hassle—Let Gnesist’s Bookkeeping Pros Take Over

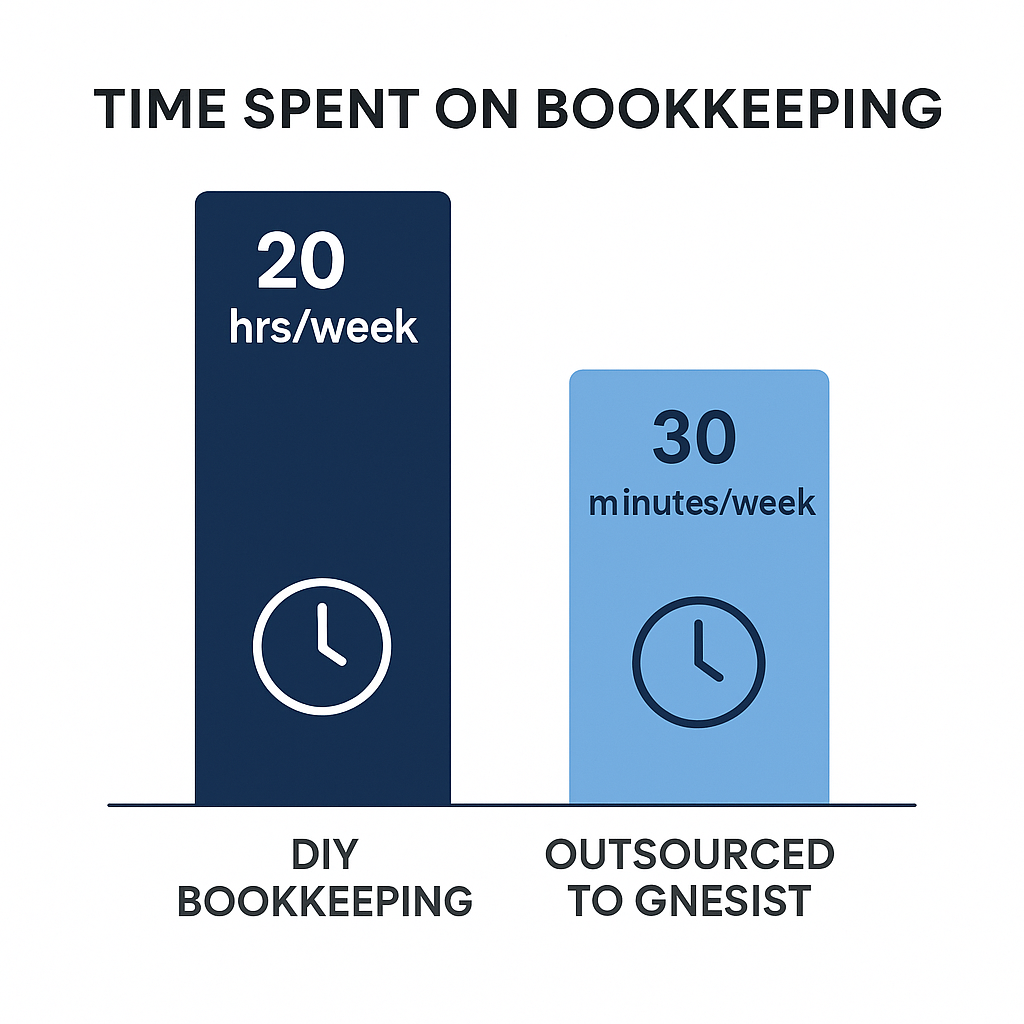

Are you still wrestling with receipts, invoices, and month-end reconciliations on your own? Imagine handing those time-consuming tasks over to Gnesist’s expert bookkeeping team—so you can focus on growing your revenue instead of chasing 1099s.

Select The Bookkeeping Plan That Best Suits Your Business Needs And Become A Gnesist Partner!

With Gnesist, you’ll never worry about missed deductions or bank-balance surprises again: we leverage industry-leading software, enforce rock-solid processes, and deliver real-time financial insights that keep you in control. Free yourself from the paperwork grind and gain the confidence of knowing your books are accurate, compliant, and ready to power smarter business decisions—every single month.

Accounting And Bookkeeping Services

At Gnesist, our Accounting And Bookkeeping Services deliver clear, accurate financial records so you can focus on growing your business. Our dedicated team acts as your virtual bookkeeper, ensuring every…

Common misconceptions about online bookkeeping services

Myth: Virtual bookkeepers lack the personal touch Many believe virtual bookkeepers are disconnected from their clients. However, modern services use various communication tools to build strong relationships and deliver tailored solutions to meet unique business needs.

Myth: Data security is compromised Despite concerns about online security, reputable virtual bookkeeping services often employ advanced security measures, including encrypted software, secure networks, and multi-factor authentication to protect sensitive information. Moreover, they typically limit access to data, providing better control than paper-based systems.

Myth: It’s only suitable for small businesses Although small businesses certainly benefit from cost savings and flexibility, businesses of all sizes can leverage virtual bookkeeping. From startups to mid-sized companies and larger enterprises, virtual bookkeeping offers scalable solutions that evolve with your company.

Myth: Implementation is complex and disruptive Many businesses hesitate to switch, fearing a difficult transition. Yet modern virtual bookkeeping solutions are designed for simplicity with user-friendly platforms, automation, and expert support ensuring a smooth transition.

Why Small Businesses Are Making the Switch Now

The financial landscape has dramatically evolved in recent years, pushing small businesses to reassess their bookkeeping approaches. Now, many are embracing virtual accounting solutions for reasons that extend well beyond simple convenience.

The post-pandemic shift to remote financial management

The COVID-19 pandemic fundamentally changed how businesses operate, accelerating the adoption of remote bookkeeping solutions. According to research, this unprecedented global event prompted companies to rethink their operational strategies and swiftly transition to remote work arrangements. As professionals and clients alike became increasingly comfortable with virtual collaboration, the demand for online bookkeeping services surged. Accordingly, even traditional financial firms began expanding their remote capabilities to accommodate this shift.

Cost comparison: In-house vs. virtual bookkeeping services

Perhaps the most compelling reason for the switch is the substantial cost difference:

- A full-time in-house bookkeeper’s annual salary averages approximately $45,000, while a full-time accountant costs around $60,000

- Combined with overhead expenses, an in-house financial team can easily exceed $100,000 annually

- Virtual bookkeeping services typically cost between $2,500-$5,000 per month ($30,000-$60,000 annually), representing savings of up to 83% compared to in-house options

- For smaller operations, some virtual services start as low as $50-$400 per month

Replacing a professional staff member who earns $46,000 annually can cost approximately $23,000 in recruitment and training—coincidentally, about the same price as outsourcing your bookkeeping needs for an entire year.

Pay-for-what-you-need flexibility

Furthermore, virtual bookkeeping offers unprecedented flexibility. Many services operate on tiered models where you pay solely for the services you require. Subsequently, as your business grows or your needs change, you can easily adjust your service level without the complications of hiring or training new staff.

This customization allows smaller businesses to access professional financial management without committing to full-time salaries or benefits. Depending on the company, you can choose between monthly financial reports or pay extra for weekly updates. This adaptability makes virtual bookkeeping particularly attractive for businesses with seasonal fluctuations or changing financial needs.

The Financial Advantage: Beyond Simple Cost Savings

Looking beyond the obvious cost reductions, virtual bookkeeping delivers significant financial advantages that impact your bottom line in multiple ways. These benefits extend far beyond simple salary savings, affecting your entire financial operation.

Eliminating hidden expenses of in-house bookkeeping

The true cost of in-house bookkeeping stretches beyond base salaries. Recruitment alone can be surprisingly expensive—finding the right accounting professionals involves advertising, interviewing, and potentially recruitment agency fees. Additionally, the financial impact of turnover disrupts operations and increases training costs for new hires. You’ll also need to provide benefits (health insurance, retirement plans, paid time off), office space, equipment, and ongoing training.

The growing accessibility of enterprise-level financial tools

Virtual bookkeeping services increasingly leverage advanced cloud-based accounting software that was previously available only to larger corporations. These platforms now offer automation, AI integration, and real-time financial data—all at a fraction of their previous cost. You gain access to sophisticated financial planning tools without the enterprise-level price tag, empowering you with capabilities like automated billing features and expense management.

Pay-for-what-you-need flexibility

Most virtual bookkeeping services operate on tiered pricing models based on your business needs. For instance, QuickBooks Live adjusts monthly rates according to your average monthly expenses: $300 for businesses with monthly expenses of $0-$10,000, $500 for $10,001-$50,000, and $700 for expenses exceeding $50,001. This approach ensures you’re not paying for unnecessary features or overstaffing.

Tax optimization opportunities

Virtual bookkeepers help identify potential tax benefits throughout the year. Experienced providers analyze your financial data, looking for opportunities to legally reduce taxable income. With 84% of customers agreeing that QuickBooks Live saves them time to focus on growing their business, these services free you to concentrate on revenue-generating activities rather than tax preparation.

Reducing costly financial errors

Automation significantly reduces manual data entry errors that plague traditional bookkeeping. According to research, approximately 90% of spreadsheets contain errors, which can lead to costly mistakes in financial reporting. Virtual bookkeeping platforms minimize these risks through automated systems that handle complex financial transactions with precision, ensuring your financial records remain accurate and reliable.

5 Unexpected Benefits of Virtual Bookkeeping Services

Beyond the commonly discussed advantages, virtual bookkeeping offers remarkable benefits that many small business owners discover only after making the switch. These hidden advantages often become game-changers for growing companies seeking competitive edges.

Real-time financial insights and decision-making

Virtual bookkeeping transforms static financial reports into dynamic dashboards that update continuously. This real-time visibility enables you to spot trends, identify opportunities, and address issues before they escalate. With instant access to current financial data, you can make prompt, informed decisions regardless of your location. Furthermore, these platforms eliminate the delays inherent in traditional reporting methods, allowing you to respond swiftly to market shifts.

Enhanced security protocols beyond traditional methods

Contrary to common concerns, virtual bookkeeping often provides superior security compared to traditional methods. Top providers implement enterprise-level protections including advanced encryption, multi-factor authentication, and secure backup systems. Notably, the structural separation of duties in virtual bookkeeping prevents any single person from controlling the entire financial process—a critical safeguard that’s challenging to implement in small businesses with limited staff.

Environmental impact of paperless financial management

The ecological benefits of virtual bookkeeping extend far beyond your office. By eliminating paper-based processes, you help reduce deforestation, which is responsible for over 14% of global deforestation. Given that Americans use approximately 680 pounds of paper annually, shifting to digital bookkeeping significantly decreases your carbon footprint. Above all, reducing paper consumption helps lower pollution from paper production and decreases methane emissions from paper decomposition in landfills.

Integration with emerging business technologies

Virtual bookkeeping services excel at connecting with other business systems. Modern platforms seamlessly integrate with inventory management software, payment processing tools, and customer relationship systems. These integrations minimize manual data entry, streamline workflows, and provide comprehensive financial visibility across your entire operation.

Scalability without proportional cost increases

As your business grows, your bookkeeping needs evolve—yet virtual services can expand without proportional cost increases. You can adjust service levels based on changing requirements without hiring additional staff or paying for unused capacity. This flexibility ensures you receive precisely the level of support needed at each growth stage without the traditional overhead increases that typically accompany expansion.

Top Software That Powers the Benefits of Virtual Bookkeeping With Gnesist

A standout advantage of Gnesist’s virtual bookkeeping is our mastery of every leading platform—from QuickBooks and Xero to FreshBooks, Wave, and beyond—so you get the precision, flexibility, and insights only top-tier software can deliver.

How Virtual Bookkeepers Support Business Growth

Many small business owners discover that virtual bookkeepers do much more than maintain records—they actively drive business growth through specialized expertise and tools.

Strategic financial planning with expert guidance

Virtual bookkeepers bring professional financial analysis to the table, helping you assess your current financial position and establish realistic long-term goals aligned with your strategic objectives. These specialists excel at building scenario analyses that simulate different future situations and evaluate their potential financial impact on your business. Through this process, they help you anticipate market shifts and prepare for potential disruptions before they occur. In fact, virtual CFO services take strategic planning even further by providing data-backed insights that enable smarter, bolder decisions about your company’s future.

Cash flow optimization techniques

Effective cash flow management remains fundamental to business stability and growth. Virtual bookkeepers implement proven techniques to improve your financial liquidity. They meticulously track invoices and follow up with late-paying clients, consequently improving your collection rates and reducing the time between service delivery and payment. They simultaneously monitor expenses, identifying areas where costs can be reduced or optimized to align with revenue goals. Virtual bookkeepers can generate detailed cash flow statements based on historical data, hence allowing you to anticipate potential gaps and plan accordingly.

Identifying hidden profit opportunities

Perhaps the most valuable benefit of virtual bookkeeping lies in spotting opportunities others might miss. Through detailed financial analysis, these professionals identify patterns and trends in your data that reveal which products or services generate the highest margins. They examine expense categories to find inefficiencies that, once addressed, directly improve your bottom line. To this end, many virtual bookkeepers also provide budget management capabilities that help you plan future investments with greater precision.

The real power comes from having access to continuously updated financial information. In light of this real-time visibility, you gain the ability to make prompt, data-driven decisions that support sustainable growth rather than merely reacting to financial challenges after they emerge.

Choosing the Right Virtual Bookkeeping Service

Selecting the ideal virtual bookkeeping partner requires careful evaluation to ensure you reap maximum benefits from the service. Unlike traditional hiring, virtual partnerships demand different assessment criteria focused on technology, communication, and specific expertise.

Essential qualifications to look for

Look for providers with relevant credentials such as CPA (Certified Public Accountant) or CMA (Certified Management Accountant) certifications. Industry-specific experience is equally crucial—bookkeepers familiar with your business sector understand unique challenges you face. Additionally, inquire about their ongoing professional development practices as this indicates commitment to staying current with financial regulations and best practices.

Software compatibility considerations

Initially, confirm which accounting platforms the service uses—popular options include QuickBooks, Xero, and FreshBooks. Yet compatibility goes beyond software names; ask specifically whether they can integrate with your existing systems and whether they provide training for any new tools. Throughout this conversation, determine if they offer support for data migration during transitions between platforms.

Questions to ask potential providers

Start by requesting a detailed outline of their service offerings. Second, inquire about their communication protocols—how often will they provide updates? Finally, ask for references from businesses similar to yours, especially those achieving measurable financial improvements through their services. Likewise, request clear explanations of all costs, including potential fees for additional services or work beyond standard scope.

Red flags to watch out for

Beware of disorganization in file management—a qualified virtual bookkeeper maintains meticulous records. Frequent mathematical errors or numerous corrections indicate potential competency issues. Obviously, poor responsiveness to communications signals trouble ahead. Inconsistent financial reporting or missing information in statements should immediately raise concerns. Whenever you notice repeated amendments on tax documents or financial statements, this typically reveals deeper issues with expertise or attention to detail.

Conclusion

Virtual bookkeeping stands out as a smart choice for small businesses aiming to streamline their financial operations. Rather than spending $100,000+ annually on in-house staff, you can access professional financial services at a fraction of the cost while gaining enterprise-level tools and real-time insights.

The advantages extend well beyond cost savings. Advanced security protocols protect your sensitive information, while paperless operations reduce your environmental impact. Most importantly, virtual bookkeepers serve as strategic partners, helping you spot growth opportunities and optimize cash flow through data-driven decisions.

Making the switch to virtual bookkeeping might seem daunting at first, but the long-term benefits make it worthwhile. Consider partnering with Gnesist’s professional bookkeeping services to transform your financial management and free up valuable time for growing your business.

The future of small business bookkeeping is undeniably digital. Companies that embrace this shift now position themselves for greater efficiency, better financial control, and sustainable growth in an increasingly competitive market.

Enjoy The Benefits of Virtual Bookkeeping With A Gnesist Bookkeeping Plan!

Accounting And Bookkeeping Services

At Gnesist, our Accounting And Bookkeeping Services deliver clear, accurate financial records so you can focus on growing your business. Our dedicated team acts as your virtual bookkeeper, ensuring every…

FAQs

Q1. Is virtual bookkeeping in high demand for small businesses in 2025? Yes, virtual bookkeeping is experiencing significant demand, especially among small businesses. As companies seek cost-effective solutions and embrace remote work, the need for skilled virtual bookkeepers who can provide financial support and expertise from anywhere has grown substantially.

Q2. How does virtual bookkeeping compare to traditional in-house bookkeeping in terms of cost? Virtual bookkeeping is generally more cost-effective than traditional in-house bookkeeping. While an in-house bookkeeper can cost over $100,000 annually including salary and benefits, virtual bookkeeping services typically range from $30,000 to $60,000 per year, offering potential savings of up to 83%.

Q3. What are the main advantages of switching to virtual bookkeeping services? Key advantages include cost efficiency, access to advanced financial tools, real-time financial insights, enhanced data security, and the ability to scale services as your business grows. Virtual bookkeeping also offers flexibility in service levels and helps reduce errors through automation.

Q4. How do virtual bookkeepers contribute to business growth? Virtual bookkeepers support business growth by providing strategic financial planning, optimizing cash flow, identifying profit opportunities, and offering data-driven insights for decision-making. They help businesses anticipate market shifts and prepare for potential financial challenges.

Q5. What should I look for when choosing a virtual bookkeeping service? When selecting a virtual bookkeeping service, consider their qualifications (such as CPA or CMA certifications), industry-specific experience, software compatibility with your existing systems, communication protocols, and references from similar businesses. Also, be wary of red flags like disorganization, frequent errors, or poor responsiveness.