The Best Outsourced CFO Services That Deliver Results and Profit

Running a business is hard enough without also trying to be your own CFO. Every growing company reaches a point where basic bookkeeping isn’t enough. Hiring a full-time Chief Financial Officer can be prohibitively expensive. In fact, a full-time CFO can command a total compensation well above $300,000 per year! That’s after bonuses and benefits are included. For most small companies, that cost is simply out of reach.

The good news is that outsourced CFO services – essentially a Part-Time CFO for your business. The service offers the same high-level financial expertise at a fraction of the cost. With outsourced CFO solutions, companies can access seasoned financial leadership for as little as $1,500 to $8,000 per month. Instead of a six-figure salary, giving them executive-level support that delivers results and profit without breaking the bank.

Fuel Your Business Growth with Gnesist’s Outsourced CFO Services

Fractional CFO Services

Unlock the financial potential of your business without the commitment of hiring a full-time executive. Our fractional CFO services provide expert financial leadership tailored specifically for your growing business. With the support of our seasoned professionals, you’ll gain strategic insights,…

Once your business hits certain milestones (like ~$1 million in revenue), expert financial guidance becomes crucial. You’ll face tough challenges such as improving profit margins, evaluating new opportunities, or securing growth capital. That’s when outsourced CFOs can step in as on-demand financial leaders. In this guide, we’ll explain what an outsourced CFO does, and the benefits of outsourced CFO services. We will also go over the typical pricing models and cost of CFO services. Which will allow you to leverage modern tech tools and outsourced CFO solutions to drive value. You’ll see why even small companies need a CFO presence. In addition on how an outsourced chief financial officer provides exactly that, in a flexible, scalable way.

What Are Outsourced CFO Services?

Outsourced CFO services (also known as fractional CFO or Contract CFO services) refer to hiring an experienced Chief Financial Officer on an as-needed basis. The part‑time CFO works on specific projects rather than holding a full‑time, in‑house role. They provide high‑level financial leadership to several clients and can adjust their schedule to match yours. Think of this expert as a financial quarterback who calls strategic plays for your business. You engage them only when required and pay solely for the time or projects you use.

An outsourced chief financial officer usually works remotely or visits the office only part‑time, often through a specialized CFO firm. The Outsourced CFOs have guided many companies in several industries, so they bring proven strategies and fresh ideas. You can hire them for a few days each month, use them for a single project such as an audit or fundraising, or keep them on retainer for ongoing advice. This model is highly flexible because you can scale hours up or down as needed without the long‑term cost of a full‑time executive.

Most outsourced CFO arrangements are contract-based, with common pricing models including a monthly retainer. A retainer is a flat fee for a set scope of work, or an hourly rate for specific tasks. This contract CFO model lets you tap into high-level financial expertise on-demand. For example, you might use outsourced CFO services for strategic planning each quarter, or for a major transaction. The CFO can also oversee your accounting team a few hours each week. Either way, you gain a seasoned financial executive who serves as your outsourced CFO solution. Benefiting from all the insights and leadership of a traditional CFO, but with far more flexibility and cost-efficiency.

An Extension of Your Team (Without the Full-Time Cost)

Think of an outsourced CFO as your on-call financial executive. They integrate with your team and processes, but they aren’t a permanent employee on your payroll. This setup has several advantages. First, you only pay for what you need – whether that’s 10 hours a month or a temporary engagement during a growth phase. Second, outsourced CFO services can often provide not just one person, but access to a team of financial professionals. Many firms pair their CFOs with controllers, analysts, or bookkeepers to support execution. This means when you hire a contract CFO, you often get an entire finance support package behind them (for example, bookkeeping and controller oversight in addition to CFO-level strategy).

Illustration: Outsourced CFO vs. Controller vs. Staff Accountant – An outsourced CFO service often comes with a hierarchy of finance roles. The outsourced CFO focuses on high-level strategy (funding, pricing models, growth plans), the Controller handles financial analysis and reporting (cash flow, budgets, forecasting), and staff accountants execute daily tasks (payables, receivables, reconciliations). This tiered approach ensures comprehensive financial management without having to hire a full in-house department.

In contrast to a traditional setup, an outsourced CFO doesn’t need a corner office or a full-time presence. They might work virtually, join leadership meetings when needed via video call, and use cloud-based accounting systems to stay on top of your numbers. The outsourced CFO brings an outsider’s perspective free of company politics, which can be invaluable. They can spot red flags and opportunities you might overlook because you’re “too close” to day-to-day operations. And if your needs ever change, you can scale the engagement up or down easily – no difficult hiring or firing decisions. This agility makes outsourced CFO services especially appealing for startups and small to mid-sized businesses navigating growth or change.

Why Small Companies Need a CFO – and When to Use a Part-Time CFO

Many small businesses operate without any CFO at all – often the CEO or owner doubles up to manage finances. In fact, surveys show close to 70% of small businesses handle all finances in-house (usually by the owner or an office manager). Early on this might work, but as a company grows, the lack of financial expertise can hold it back. Why do small companies need a CFO? Because once you reach a certain scale or complexity, strategic financial decisions become too important to make on gut instinct alone. A part-time CFO can fill this gap long before you can justify a full-time hire. Here are a few common signs that signal it’s time to bring in an outsourced CFO:

Passing the Million-Dollar Mark

- Hitting roughly $1–5 million in annual revenue is a turning point. At that level, finances become more complex and small mistakes get magnified. Sure, a bookkeeper or basic accounting software handled things in the early days. But once you cross the ~$1M threshold, you likely have multiple product lines, higher expenses, and maybe investors showing interest. This is when strategic financial planning and analysis are needed to continue growing. Most businesses find they need CFO-level insight once they reach this stage.

Rapid Growth is Straining Your Finances

- If your business is growing 20%+ year over year, that’s great – but such growth can outpace your financial systems. Booming sales can actually cause cash flow crunches if not managed carefully. When growth makes your head spin, an outsourced CFO can impose order. They’ll ensure you have cash flow forecasts, working capital management, and scalable processes so that growth doesn’t turn into a crisis. Without a CFO’s guidance, fast-growing companies risk running out of cash, missing opportunities, or making sloppy financial decisions that hurt later.

Preparing to Seek Investors or Loans

- The moment you consider raising capital – whether from venture investors, banks, or even selling a stake – you should bring on a CFO (at least on a fractional basis). An outsourced CFO will get your financial house in order before you pitch. They’ll create credible financial models, forecasts, and dashboards that investors want to see. They can help determine how much capital you truly need and ensure you present a compelling story backed by solid numbers. Perhaps most importantly, they add credibility. Investors have more confidence in a business that has professional financial leadership. Don’t walk into funding meetings without a CFO-level partner prepping you.

Facing Major Financial Decisions

- Certain inflection points – launching a new product line, entering a new market, acquiring another business, or restructuring debt – carry high stakes. During these big decisions, having an experienced CFO’s input is like having a financial compass. For example, if you’re considering an acquisition, a contract CFO can conduct due diligence, perform valuation analyses, and model out scenarios. If you’re rethinking pricing strategy, a CFO can analyze margins and customer value to guide the change. When the decisions will shape your company’s future, outsourced CFO services ensure you’re basing choices on rigorous financial analysis, not guesswork.

In short, small companies need a CFO when financial complexity grows beyond the owner’s expertise. An outsourced or fractional CFO provides that higher-level guidance exactly when it’s needed. You don’t have to be a big company to benefit from CFO insights – you just need to recognize those moments when expert financial leadership will pay for itself many times over. As one CFO survey noted, over 40% of CFOs themselves plan to outsource more work to external experts as a strategy to optimize costs and access skills. The model of bringing in outsourced CFO solutions during critical periods is increasingly common and viewed as a best practice rather than an emergency measure.

The Benefits of Outsourced CFO Services

If you’re wondering what the real payoff is for using an outsourced CFO, consider the core benefits of outsourced CFO services for your business. In many cases, a fractional CFO can deliver 60% or more cost savings compared to a full-time hire, while driving improvements in profit and performance. Here are the major advantages to keep in mind:

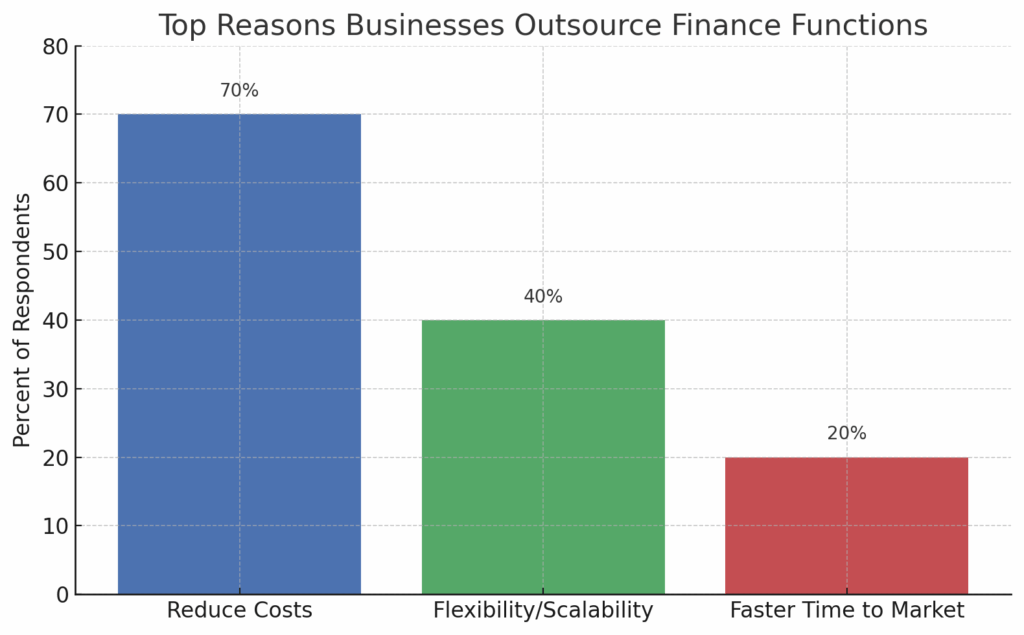

Data: Top reasons businesses choose outsourced accounting/CFO services (Deloitte Global Outsourcing Survey). Cost savings is the #1 driver (cited by 70% of business owners who outsource finance functions), followed by greater flexibility and scalability (40%), and faster speed-to-market for growth (20%). These benefits allow small companies to focus on their core business while gaining expert financial support.

- Significant Cost Savings: Cost is often the first reason companies turn to outsourcing, and for good reason. A full-time CFO earning a six-figure salary, plus bonuses and benefits, is a huge expense. By contrast, outsourced CFO services typically charge a flat monthly fee or hourly rate that ends up being much lower annually. On average, businesses see around 60% lower annual cost by outsourcing a CFO versus hiring in-house. You’re not paying for downtime, benefits, or corporate overhead – just the expertise you need. Those savings can be reinvested into business growth. Example: Instead of paying $300,000+ for a full-timer, you might pay $5,000/month (=$60k/year) for a contract CFO — instantly freeing up over $200k to put toward marketing, product development, or hiring salespeople.

- High-Level Expertise and Experience: With an outsourced CFO, you gain seasoned financial leadership often far beyond what you could afford to hire full-time. Many outsourced CFOs have decades of experience, including prior CFO roles at other companies. (In fact, 100% of outsourced CFOs have prior CFO experience, whereas less than 20% of full-time CFO hires have been a CFO before.) This means they’ve “seen it all” – multiple industries, downturns and booms, various financial challenges – and can apply that knowledge to your business. It’s like getting a veteran mentor who can instantly identify what works and what doesn’t. They also come with battle-tested playbooks for improving cash flow, profitability, and efficiency, honed across many clients. You get the benefit of experience and insight without the trial-and-error a rookie CFO might require.

- Strategic Financial Focus (While You Focus on Core Business): One big benefit of outsourced CFO services is that it lets the CEO/owner focus on running the company, while the CFO focuses on the finances. Many small business owners spend countless hours on accounting or figuring out financial plans – time that could be spent growing the business. By outsourcing the CFO role, you free up management’s time to concentrate on core operations, knowing an expert is keeping the financial house in order. The CFO will provide only the analysis and reporting you need for decisions, filtering out the noise. This allows for better decision-making at the top. As a Deloitte survey found, 65% of companies outsource to enable focus on core functions, and 63% cite cost-cutting as a key benefit. An outsourced CFO delivers on both: letting you focus on what you do best while they handle financial strategy and cost optimization.

- Flexibility and Scalability: Unlike a static full-time hire, outsourced CFO services are highly flexible. Need more help during budgeting season or a transaction? Scale up hours that month. Business slowed or finances steady for now? Scale back to a lighter touch. This scalability means you’re never overpaying during slow periods, and you can quickly get extra support during high-need times. Additionally, you can tailor the expertise to your situation – for instance, engage a CFO with specific industry knowledge or one skilled in turnarounds if that’s what you currently require. If your needs change, you can even switch to a different outsourced CFO with a different skill set. This agility is something a full-time hire can’t match. Essentially, outsourced CFO solutions grow with you: they’re there as needed, in the exact capacity that benefits you most.

- Objective External Perspective: Sometimes a company’s biggest financial issues are hiding in plain sight. An in-house CFO, immersed in the company’s culture and past decisions, might have blind spots or biases. An outsourced chief financial officer, on the other hand, brings fresh eyes and an outsider’s objectivity. They can ask hard questions and challenge assumptions that internal teams might shy away from. There are no “sacred cows” for an outside expert – everything is on the table to improve financial performance. This fresh perspective often uncovers opportunities for efficiency or risks that need addressing. Because an outsourced CFO isn’t caught up in office politics, they provide honest, unbiased advice focused solely on the company’s best interests. Many business owners find this perspective invaluable – it’s like getting a clear second opinion on your strategy from a financial standpoint.

- Established Systems and Processes: When you hire an outsourced CFO service, you aren’t just getting a person – you’re getting access to robust financial systems and best practices developed over many clients. Outsourced CFO firms often have templates for reporting, proven workflows for closing books quickly, effective KPI dashboards, and so on. They will upgrade your financial processes (reporting, budgeting, forecasting) to a more professional level. For example, they might implement a rolling cash flow forecast model or set up an improved budget vs. actual reporting system. They’ll also ensure strong internal controls to protect against fraud or errors. Small businesses that engage outsourced CFOs frequently see their financial operations become more streamlined and automated, as the CFO introduces efficiency improvements. Over time, this leads to faster insights and better financial management even when the CFO isn’t around day-to-day.

In summary, the benefits of outsourced CFO services boil down to experienced financial leadership, on demand – providing strategic direction, ensuring fiscal health, and positioning the business for growth – all at a cost and commitment level that makes sense for smaller companies. It’s about working smarter financially without the burden of a heavy full-time expense.

What Does an Outsourced CFO Do? Key Responsibilities and Services

By now you might be asking, what does an outsourced CFO do in practical terms? An outsourced CFO’s responsibilities mirror those of a traditional CFO – from high-level strategy down to overseeing financial operations – but scaled to the scope you need. Here are some of the core services and duties an outsourced CFO (or outsourced CFO solutions provider) will typically handle:

- Strategic Financial Planning: One of the foremost duties is developing and updating your financial strategy or “game plan.” The CFO will work with you to map out a financial roadmap for achieving your goals. This includes analyzing your company’s current financial position, identifying opportunities (like untapped markets or cost savings), and flagging issues holding you back. They’ll help create budgets and forecasts aligned with your growth targets, and continuously adjust the plan as conditions change. Essentially, the CFO serves as the financial architect of your business plan, ensuring you have a clear path to profitability and growth.

- Cash Flow Management: “Cash is king”, and outsourced CFO services put heavy focus on cash flow. The CFO will implement cash flow forecasting so you can see upcoming cash needs or surpluses in advance. They’ll manage timing of receivables and payables to keep your cash conversion cycle healthy. If there are seasonal swings or cash crunch risks, they’ll develop strategies (like credit lines or expense adjustments) to ensure you can always cover obligations. No more sleepless nights worrying if you can make payroll – a good CFO will establish clear cash reserves and projections so you’re never caught off guard.

- Financial Reporting & Analysis: An outsourced CFO will upgrade your financial reporting to provide deeper insight into your business. They’ll ensure you have timely, accurate financial statements each month and that you’re tracking key performance indicators (KPIs) relevant to your business. Beyond just producing reports, they analyze the numbers to extract actionable findings. For example, they might analyze product line profitability, customer acquisition cost vs. lifetime value, or departmental spending variances. You’ll gain an understanding of the story behind the numbers. This analysis supports better decision-making – you’ll know which areas are most profitable, which costs are too high, and where to focus efforts.

- Systems Implementation & Process Improvement: Small businesses often make do with basic tools like spreadsheets or entry-level software. An outsourced CFO can assess if your current financial systems are sufficient and suggest improvements. They might implement accounting software upgrades or integrate add-ons for automation. Many outsourced CFOs introduce dashboard tools or business intelligence systems that give you real-time visibility into financial metrics (more on tech tools shortly). They will also streamline processes: for instance, tightening up the month-end close process, instituting proper expense approval workflows, or improving how financial data is collected and recorded. The goal is to build scalable systems that can grow with the company. By eliminating bottlenecks and manual work, the CFO frees up your team’s time and reduces errors.

- Budgeting and Forecasting: Your outsourced CFO will coordinate the budgeting process, turning your strategic goals into a detailed financial budget each year (or quarter). They’ll work with department heads to set revenue targets and expense limits that align with overall objectives. Importantly, they will create financial forecasts – projections of revenue, expenses, and cash flow – looking ahead 12-24 months or more. These rolling forecasts let you preview potential outcomes (best case, worst case, expected) and prepare accordingly. If the forecast shows a cash shortfall six months out, you have time to react (cut costs, arrange financing, etc.). If it shows surplus cash, you can plan how to invest it. Regular forecasting is something many small firms lack; an outsourced CFO ensures you are forward-looking in your financial management.

- Fundraising and Investor Relations: When it comes to raising capital – whether seeking loans, bringing on investors, or even selling the business – an outsourced CFO is indispensable. They will help determine optimal funding strategies and how much to raise (so you don’t dilute equity unnecessarily). The CFO can prepare pitch decks and the detailed financial projections that lenders or investors require. During investor meetings, the CFO can join to answer in-depth financial questions and provide credibility. If you secure funding, the CFO manages the due diligence process, coordinates with accountants or lawyers, and ensures a smooth close. Ongoing, they might handle investor relations, providing financial updates to your stakeholders. Essentially, the CFO acts as the interface between your numbers and the outside financial world – speaking the language of investors and bankers to get you the capital you need.

- Risk Management and Compliance: A less glamorous but vital CFO role is protecting the business through risk management and ensuring compliance. An outsourced CFO will put proper controls in place – for example, separating duties in accounting to prevent fraud, or establishing approval rules for large expenditures. They’ll review insurance coverage, identify financial risks (like too much debt or exposure to interest rate changes), and devise mitigation plans. Compliance-wise, they make sure your financial practices meet tax laws, accounting standards, and any industry-specific regulations. This oversight shields you from costly penalties or surprises. Think of the CFO as a financial security system, always on guard for threats to your company’s financial health and longevity.

- Advisor to the CEO and Board: Finally, an outsourced CFO serves as a key advisor and sounding board for the CEO (and board, if you have one). They bring an analytical, financially grounded perspective to strategic discussions. Considering a new product line? The CFO will project its impact on margins and cash. Thinking of expanding to a new location? The CFO models the investment versus the expected return. This helps the leadership make informed, data-driven decisions. A good CFO also flags issues proactively – if they see a troubling trend in the financials, they’ll raise it and propose solutions, not wait for it to become a bigger problem. In short, they act as a trusted financial counselor, keeping leadership focused on sustainable growth and profitability.

These responsibilities illustrate what outsourced CFO services actually do: They take ownership of the financial side of the business, from big-picture strategy down to nuts-and-bolts execution, all with the goal of improving your company’s financial performance. When you have an outsourced CFO engaged, you should expect regular strategy sessions, actionable analyses, and a financial roadmap that’s clear and aligned with your business goals. If something falls under “finance” or “numbers,” it’s in your CFO’s domain to oversee and optimize.

Leveraging Technology: How Outsourced CFOs Use Tech Tools and AI

Modern outsourced CFO services don’t just bring financial expertise – they also bring along cutting-edge technology tools to supercharge your finance function. In today’s world, the CFO’s tech stack is a crucial part of delivering fast, accurate insights. A great outsourced CFO will introduce and utilize the latest financial tech on your behalf, which is a major value-add of outsourced CFO solutions. Here’s how they leverage technology:

Cloud Accounting and ERP Systems: Most small companies start with software like QuickBooks or Xero. An outsourced CFO will ensure you’re maximizing these systems, and advise if/when it’s time to upgrade to a more robust ERP (Enterprise Resource Planning) system as you scale. They set up your accounting software with the proper chart of accounts and integrations.

Many CFOs use cloud-based accounting tools that allow real-time collaboration (so your books can be updated remotely and you can view financials anytime). A benefit of outsourced CFOs working with multiple clients is they know which software is best for different scenarios – whether it’s a lightweight system for a lean startup or something like NetSuite for a more complex operation. They’ll help implement new software and train your team on it as needed.

Financial Planning & Analysis (FP&A) Tools: Gone are the days of building every model from scratch in Excel (though Excel remains a staple). Outsourced CFOs often deploy dedicated FP&A software to streamline budgeting, forecasting, and reporting. For example, tools like Fathom or Jirav can connect to your accounting data and generate dashboards and reports automatically.

These tools enable dynamic forecasting and “what-if” scenario analysis without hours of manual work. An outsourced CFO will set up key reports and metrics in a financial dashboard, so you as the business owner get a clear visual on your KPIs – from cash burn rate to profit margins – in real time. As Strongbox (a financial software firm) notes, connecting your accounting system to such tools allows CFOs to spend less time gathering data and more time analyzing it for insights.

Automation and Integration: Many finance tasks can now be automated, and outsourced CFOs are adept at implementing these efficiencies. They might use automation tools to fetch bank transactions, reconcile accounts, or issue invoices and reminders automatically. They ensure your systems “talk” to each other – for instance, integrating your sales software with accounting, so revenue data flows in without manual entry. By eliminating tedious, error-prone manual processes, they reduce costs and errors, and get you faster data. This is especially useful for managing higher transaction volumes as you grow, without having to proportionally increase headcount. A lean finance tech stack put in place by an outsourced CFO can often handle work that would otherwise require additional staff.

Data Analysis and BI: To complement financial software, CFOs use Business Intelligence (BI) and data analysis tools to dive deeper into data. While the accounting system shows the financial results, a CFO might utilize BI tools (like Tableau, Power BI, or even advanced Excel modeling) to uncover trends and correlations. For example, analyzing customer purchasing data to find opportunities to upsell, or pinpointing which operational expenses don’t contribute much to revenue.

They might build custom reports or export data to analyze it in flexible ways that standard accounting reports can’t. The result is actionable insights – maybe discovering that one product line has a far better margin than others, or that a certain expense category is growing faster than revenue (signaling a need for cost control). These insights help drive strategic adjustments quickly.

AI and Predictive Analytics: The newest frontier in the CFO tech toolkit is Artificial Intelligence. While still emerging, AI tools are increasingly being used in finance. Many outsourced CFOs (especially those serving tech-savvy clients) are beginning to leverage AI-driven software. For instance, AI can help forecast financial outcomes more accurately by analyzing vast amounts of historical data and external factors. It can also detect anomalies – e.g. flagging unusual transactions that might indicate errors or fraud. According to recent reports, more than 8 in 10 CFOs at large companies are either using or considering AI for core financial functions like accounts payable and financial analysis.

AI “copilots” are emerging in FP&A platforms to assist with scenario planning, and AP automation tools use AI to spot invoice irregularities. While a small business may not need cutting-edge AI right away, having an outsourced CFO who is aware of these trends means you won’t fall behind. They can introduce appropriate AI-powered features when you’re ready – for example, implementing an AI-based expense auditing tool that saves countless hours and prevents overpayments.

Collaboration and Communication Tech: Since outsourced CFOs often work remotely, they make heavy use of communication tech to stay plugged into your company. Expect regular virtual meetings via Zoom or Teams for strategic reviews. They might set up shared project management boards or use collaboration software (like Slack or Microsoft Teams channels) to enable quick questions and updates with your staff.

Modern outsourced CFO services are very transparent – some will provide an online portal where you can see status of tasks, reports delivered, and even track the CFO’s time or activities. This use of collaboration tech ensures that even if your CFO is not in the office, you have real-time access and visibility into what they’re doing and what your financial status is.

In essence, an outsourced CFO will build a tech-enabled finance function for your business. Small companies that may have been using minimal tools suddenly get access to a sophisticated finance tech stack through their outsourced CFO. This not only improves accuracy and efficiency, but also positions your company to handle greater scale. The combination of expert guidance and smart technology is powerful – it means your financial insights are delivered faster, with more depth, and with less effort required from you or your team. Over time, this tech-driven approach will help your business stay competitive, lean, and well-informed.

And importantly, as new technology emerges (like improved forecasting tools or updated accounting standards in software), your outsourced CFO keeps you ahead of the curve. They are continuously learning and implementing best-in-class tools across their clients, so you benefit from state-of-the-art financial management without having to figure it all out yourself.

Maximizing Value from Your Outsourced CFO Partnership

Engaging outsourced CFO services is an investment in your company’s future – but to reap the full benefits, you should approach the partnership thoughtfully. Here are some tips to get the most value out of your outsourced CFO engagement:

1. Set Clear Goals and Expectations Upfront: Begin the relationship by clearly defining what success looks like. Identify your pain points and priorities – for example, are you most concerned with fixing cash flow issues? Improving your profit margins? Preparing for a fundraising round? Be as specific as possible about the objectives you want your CFO to achieve. Then, work with the CFO to outline the scope of services, deliverables, and timeline. Get this in writing via an engagement letter or contract. If the arrangement is retainer-based, define what is included (e.g. “prepare monthly financial reports, lead quarterly strategy sessions, and on-call support for ad hoc questions”).

Misalignment can lead to disappointment on both sides, so ensure you’re on the same page from day one. Set key performance indicators (KPIs) or milestones if appropriate (for instance, “reduce overhead expenses by 10% in six months” or “achieve on-time monthly closes within 5 days after month-end”). This way, both you and the outsourced CFO have a shared definition of success to work toward.

2. Communicate Regularly and Openly: Treat your outsourced CFO like a true executive team member. Establish a regular communication cadence to stay aligned. This might include a weekly check-in call to address immediate issues, a monthly deep-dive meeting to review financial performance, and quick emails or messages as needed in between. Make sure the CFO is looped in on major business updates (good or bad) – e.g. big sales wins, loss of a key customer, operational challenges – as these all have financial implications.

Encourage your CFO to ask questions and don’t hesitate to ask them for clarification on reports or recommendations. The best outcomes arise when there is high transparency. Also, if you have other leadership team members (COO, head of sales, etc.), facilitate direct interaction between them and the CFO. For example, the CFO might meet with sales heads to refine revenue forecasts or with operations managers to discuss cost controls. Open lines of communication ensure the CFO’s advice is based on the full picture and that their insights reach all corners of the business.

3. Act on the CFO’s Recommendations: This sounds obvious, but it’s worth emphasizing – you only get value if you implement the improvements your CFO suggests. An outsourced CFO will likely identify various strategic and operational adjustments (cutting or re-allocating certain costs, changing pricing, renegotiating supplier contracts, altering financial processes, etc.). Be prepared to make changes in response to their analysis. Start with “low hanging fruit” – quick wins that show immediate results, like adjusting payment collection processes to improve cash flow, or cancelling an underused software subscription to save money.

By taking action, you begin to see concrete ROI from the CFO service. It also creates positive momentum in the partnership. If there are reasons you’re hesitant about a recommendation (perhaps it impacts a long-time employee or a pet project), discuss it with the CFO – they may adjust the plan or provide additional data to address your concerns. Remember, the CFO’s goal is to strengthen your business, not just shuffle numbers around. Use their expertise to tackle your toughest challenges, not to sit on a shelf.

4. Track the Impact (ROI) Over Time: To truly appreciate the value of an outsourced CFO, track metrics before and after their involvement. Key areas to monitor include cash flow improvements, expense reductions, revenue growth, and profit margins. For instance, if one of the CFO’s initiatives was to reduce inventory waste, did your cost of goods sold as a percentage of sales improve after implementation? If they focused on revenue growth strategies, is your top-line trending upward? Also consider qualitative benefits: Do you feel more confident in financial decisions? Are reports coming in faster or error-free? Are investors or banks giving positive feedback about your financial reporting? These are real advantages even if they’re harder to quantify.

By monitoring results, you can also have informed discussions with the CFO about what’s working and what isn’t. Maybe quarterly gross margins are up, but cash on hand is still lower than desired – that can prompt a pivot to focus more on cash flow. Regularly reviewing the ROI of the CFO service keeps everyone accountable and focused on driving measurable outcomes. Over a year, you should be able to point to specific improvements (e.g., “Our operating expenses are 15% lower than last year, thanks in part to our CFO’s cost optimization plan”).

5. Treat the CFO as a Long-Term Partner: Even though the engagement is flexible, approach it as you would a critical hire. The more context and trust you build with your outsourced CFO, the more effective they can be. Share your vision for the company openly, including long-term goals and even your eventual exit or succession plans if applicable. The CFO can then tailor their strategy with those end-goals in mind (for example, if you plan to sell the company in 3 years, they’ll focus on maximizing EBITDA and cleaning up financial records for due diligence). Also, give the CFO feedback regularly – both positive and constructive.

If you need more frequent updates or want them to dive deeper into a certain issue, let them know. Conversely, if there’s a report or metric they provide that you don’t find useful, say so. Over time, you’ll develop a strong working rhythm. Many businesses end up working with the same fractional CFO service for years, even as they grow significantly, because the trust and understanding are there. That consistency can be an asset; your outsourced CFO accumulates deep knowledge of your business which makes their advice even more valuable.

By following these practices, you’ll ensure that outsourced CFO services deliver maximum value – not only saving costs and improving your finances, but also giving you peace of mind and more bandwidth to lead your company. The partnership works best when you fully utilize the CFO’s expertise as an integral part of your leadership team.

Outsourced CFO Services vs. Full-Time CFO: Cost Comparison

One of the most compelling reasons to choose an outsourced CFO over hiring a full-time CFO is the cost advantage. We’ve touched on cost savings as a benefit, but let’s break down the cost of CFO services more concretely and compare to an in-house CFO, so you understand the economics of this decision.

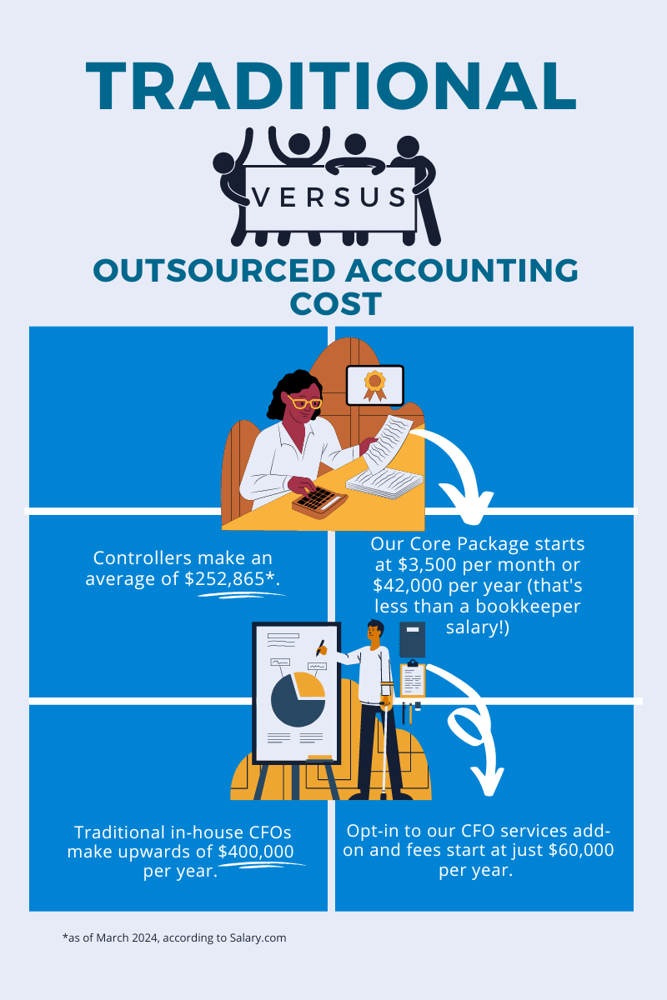

*Comparison: Traditional (In-House) vs Outsourced Accounting/CFO Cost. Controllers in-house earn around $250k/year, and in-house CFOs often make $400k+/year (total compensation) on the high end. By contrast, an outsourced CFO service package might cost $3,500 per month (around $42k/year) for core accounting plus a CFO add-on starting around $60k/year. Source: Salary.com (Mar 2024 data) and ORBA Cloud CFO.

In-House CFO Costs: Hiring a full-time CFO is expensive. Salary surveys show CFO base salaries can range from around $200,000 on the low end up to $400,000 or more for experienced CFOs at larger companies. For example, one report found 73% of CFOs earn between $201k and $400k annually. But salary is only part of the cost – you must add benefits (health insurance, retirement contributions), payroll taxes, bonuses or profit-sharing, equity grants (common if you’re a startup), and perks.

These can easily add 20-30% on top of base salary. So a $250k salary might really cost $325k+ to the company. And a top-tier CFO at $350k base could be $450k-$500k after bonus and benefits. There’s also the cost of executive search or recruitment, and the risk/cost if a hire doesn’t work out. In summary, a full-time CFO is a fixed, significant expense – often the highest-paid employee after the CEO.

Outsourced CFO Costs: Outsourced CFO services, on the other hand, offer variable, usage-based costs. The pricing model can take a few forms: some charge an hourly rate (commonly in the range of $200–$350 per hour), while others work on a fixed monthly retainer that covers a set of services (e.g. $4,000 per month for specified tasks and meetings). There are also project-based fees for specific deliverables (like $15,000 for a one-time fundraising support project).

Generally, small to mid-sized businesses can expect to pay anywhere from around $2,000 up to $12,000 per month for outsourced CFO support depending on the breadth of services and expertise. That equates to $24k–$144k per year. Most commonly, we see packages in the $5k–$8k per month range for a fractional CFO who dedicates a few days per month to the business. So roughly $60k–$100k per year is a typical investment for a comprehensive outsourced CFO engagement for a small company – substantially lower than the $300k+ all-in cost of a full-timer.

What’s Included in that Fee: It’s important to note that outsourced CFO fees often include more than just the CFO’s time. If you engage through a CFO firm, that monthly fee might also include an accounting team support, such as a part-time controller or bookkeeping oversight, as part of the package. For example, an outsourced CFO firm might have tiers: a base package covers bookkeeping and basic accounting, and their “CFO service” tier (higher fee) adds on the strategic CFO advisory.

Be sure to clarify this with providers – sometimes you’re getting a bundle of finance & accounting services under one cost, which can further justify the expense. Even if it’s just the CFO’s own services, the value they deliver (as discussed earlier) tends to far outweigh the fee in terms of improved financial results.

Cost Scalability: With a full-time CFO, cost is all-or-nothing – you’re paying their full salary regardless of your company’s fluctuations. With an outsourced CFO, the cost is scalable. If you only need them heavily involved for a few months, you pay for that period and can then scale back. If you temporarily don’t need CFO-level help (say you’re in a steady state for a quarter), you could pause or reduce the engagement. This scalability of cost can be a lifesaver for startups and seasonal businesses. You essentially pay for CFO services only when you derive value from them.

Opportunity Cost: Consider what else you could do with the money saved by choosing an outsourced CFO. For a small business, saving $200k+ per year by not hiring a full-time CFO could fund several salespeople who bring in revenue, or a major marketing campaign, or R&D for new product development.

For many, that trade-off is well worth it – you still get the financial expertise you need to safeguard and grow the business, and you free up capital for other investments. It’s about maximizing ROI on every dollar. That said, if your company grows to a size where a full-time CFO is affordable and fully utilized, you might eventually transition. But many businesses find they can reach $50M, $100M in revenue using fractional CFOs before taking the plunge on a full-timer, due to how effective and cost-efficient this model is.

To illustrate, Tee Up Advisors (a financial consulting firm) notes: “A full-time CFO commands $250K–$500K per year, with median around $300K. In contrast, a Fractional CFO costs $50K–$150K per year ($2K–$12K per month), allowing businesses to access top-tier expertise without the full-time price tag.”. That aligns with our discussion. And NOW CFO reports that on average, companies see about a 60% annual cost savings by outsourcing a CFO versus a traditional hire.

In summary, when you compare the cost of CFO services (outsourced) to an in-house CFO, the outsourced route is dramatically more affordable for small and mid-sized firms. You avoid a large fixed expense and instead pay a flexible fee that is typically a fraction of a full-timer’s salary. This cost efficiency is one of the main reasons why outsourced CFO services have become so popular, especially among startups and growing businesses that need financial guidance but must watch every dollar.

The Rising Trend: Outsourced CFO Solutions on the Rise

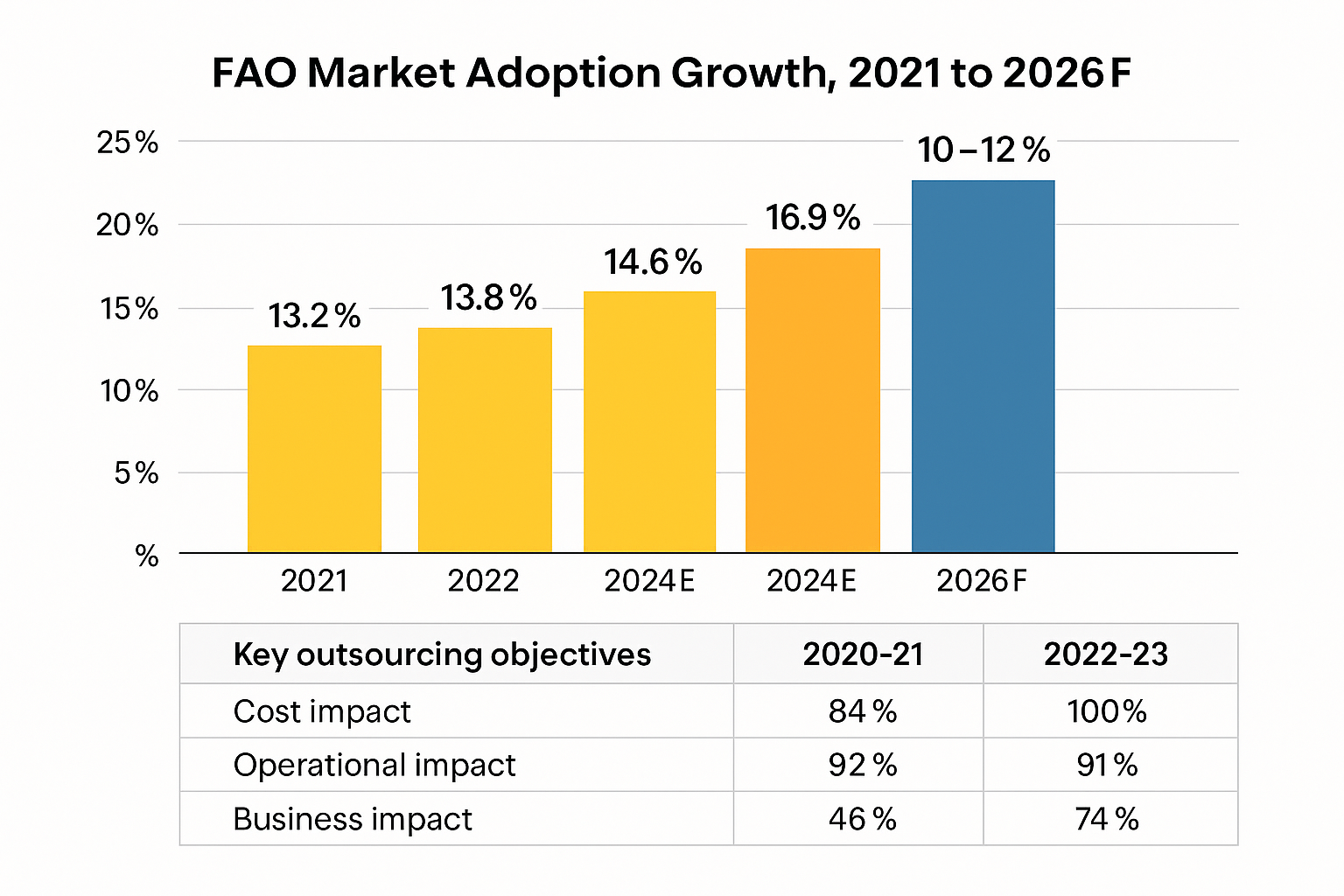

It’s worth noting that turning to outsourced CFO solutions isn’t just an isolated idea – it’s part of a broader trend in finance and accounting. Companies of all sizes are increasingly open to outsourcing critical functions to gain expertise and save costs. The Finance and Accounting Outsourcing (FAO) market as a whole has shown robust growth. In fact, even amid economic uncertainties, the FAO market grew around 10% in 2024 and is projected to grow 10–12% annually through 2026. This sustained expansion reflects that more businesses are leveraging third-party finance support (like outsourced CFOs, controllers, bookkeeping, etc.) to meet their needs.

Trend Chart: Finance & Accounting Outsourcing Market Growth – The global FAO market (in USD billions) grew from $13.2B in 2021 to $16.3B in 2023, and is expected to reach $22.1B by 2026【20†】. Companies are increasingly embracing outsourced finance functions as part of their strategy. Key objectives driving outsourcing include cost impact (nearly 100% of firms cite cost savings by 2023) and business impact (companies reporting outsourcing as driving strategic business impact rose from 46% to 74% in recent years).

Additionally, surveys of CFOs themselves show a shifting mindset. Facing talent shortages and pressure to optimize, many CFOs plan to outsource more: Over 40% of CFOs (in a 2024 survey) said that outsourcing more finance work is a key strategy to cut costs and deal with rising expenses. Interim and fractional financial leadership is in high demand – one report noted that requests for interim CFOs jumped 46% year-over-year recently as companies seek flexible solutions. Clearly, the idea of bringing in external expertise on a fractional basis has moved into the mainstream.

For small and medium businesses, the implication is that you’re not alone in choosing to outsource the CFO role – it’s an accepted and savvy move. Even larger enterprises are supplementing their teams with external experts for specialized projects or to fill gaps. The rise of fractional CFO services and similar models means the market is mature: there are many providers, transparent pricing, and proven success stories of companies that scaled successfully with an outsourced CFO guiding them.

All this is to say, you should feel confident that using outsourced CFO services is a well-trodden path. It’s no longer an unconventional idea but rather a strategic best practice for many situations. Businesses have more options than ever to get executive-level financial help on their terms. And as the trend continues, those who embrace fractional CFO solutions may gain an edge over competitors who struggle by trying to do everything in-house.

Conclusion: Unlock Expert Financial Leadership – Without the Hefty Price Tag

Stop trying to navigate your company’s financial future alone. Outsourced CFO services give you a way to get expert financial leadership for your business at a cost that makes sense. Rather than paying $300k+ for a full-time CFO (or going without and risking costly mistakes), you can engage an outsourced chief financial officer on flexible terms and save roughly 60% of the cost. It’s the best of both worlds – high-caliber financial strategy and oversight, minus the budget-breaking expense.

Don’t wait until minor issues snowball into major problems. If your business has reached that critical growth stage (crossing the seven-figure revenue mark, accelerating growth, planning a funding round, etc.), that’s the time to bring in a part-time CFO. An outsourced CFO will help you keep cash flowing smoothly, build scalable systems, and make data-driven decisions that fuel growth. They turn financial challenges into opportunities by applying experience and analysis.

To make the most of it, set clear goals, communicate often, and be ready to act on your CFO’s advice. Track the improvements in your numbers – you’ll likely see stronger cash reserves, controlled expenses, higher profits, and perhaps most importantly, newfound confidence in your financial direction. With the right outsourced CFO partner, you gain not just a consultant, but a key ally dedicated to your business’s success.

Ready to take control of your financial future? Consider tapping into Gnesist’s expertise. Our team of outsourced CFOs has a track record of delivering results for growing companies. We offer fractional CFO services that are tailored to your needs – whether you’re looking to boost profitability, prepare for investors, or simply get a better handle on your finances. You’ll get battle-tested financial strategies and hands-on support, without the full-time cost commitment. Don’t let financial complexity hold you back. Reach out to explore how an outsourced CFO can propel your business to new heights.

Learn more about our Fractional CFO Services and how Gnesist can help unlock your company’s financial potential.

Fractional CFO Services

Unlock the financial potential of your business without the commitment of hiring a full-time executive. Our fractional CFO services provide expert financial leadership tailored specifically for your growing business. With…