Sales Tax For Services – The Ultimate How To Guide!

Sales tax can be a confusing topic for service-based businesses. Unlike selling products, where it’s clear that sales tax usually applies, the rules for taxing services vary widely. In this comprehensive guide, we’ll explain what sales tax for services means, when it applies, and how different states handle it. We’ll also answer common questions (many from Gnesist clients) about specific service tax scenarios in various states. By the end, you’ll know when you should charge sales tax on services and how to stay compliant. Let’s dive in!

Professional Sales Tax Filing Service

Sales tax compliance can be complex, especially if your business operates across multiple states. Our comprehensive sales tax filing service streamlines your tax filings, keeping them accurate, timely, and stress-free.

What is sales tax for services?

Sales tax is a percentage-based tax on sales of goods or services, collected by businesses from customers and remitted to the government. Traditionally, sales tax was created in the 1930s to apply to tangible personal property (TPP) – in other words, physical goods. Back then, services weren’t typically taxed. As the U.S. economy shifted from manufacturing to services, however, many states started extending sales tax to services.

Today, sales tax for services refers to sales tax that must be collected on service transactions. Not all services are taxed, and each state defines which services (if any) are taxable. For example, hiring a lawyer or accountant (professional service) might be tax-free in most places, while hiring a landscaper or mechanic could incur sales tax in some states. The key point is that sales tax on services is not universal – it depends on state law and the type of service.

Many business owners mistakenly assume that no sales tax applies to services. In reality, over the years states have increasingly added certain services to the taxable list. If you provide services, it’s crucial to understand your state’s rules so you don’t accidentally run afoul of tax laws.

Does sales tax apply to services?

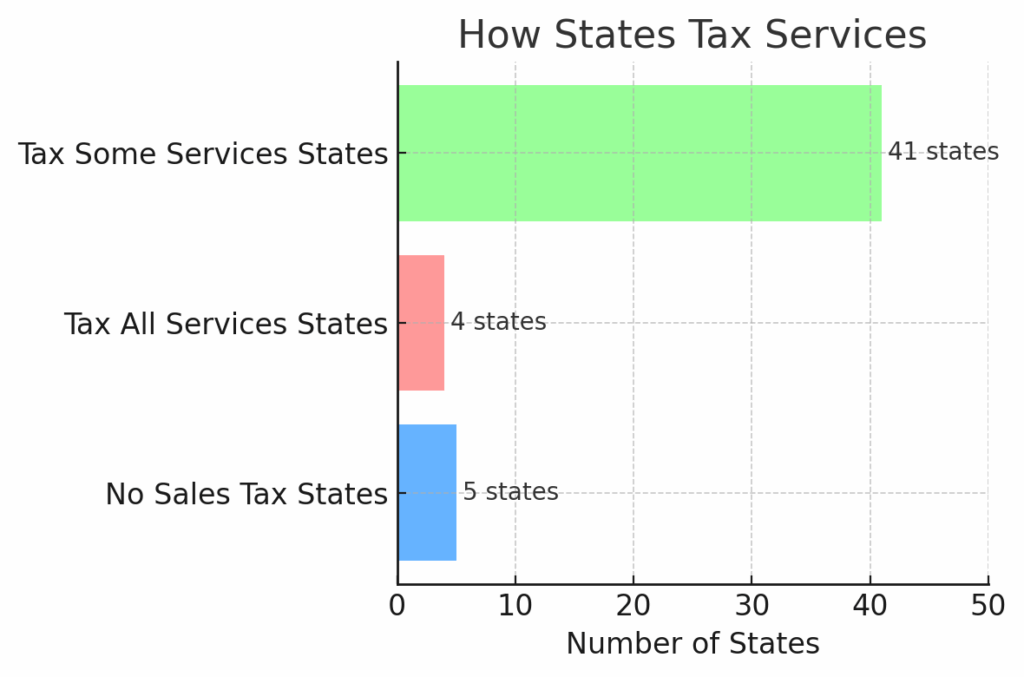

It depends on the state. Sales tax on services is not handled the same way across all states – far from it. Each state has its own approach to taxing services. Broadly, states fall into a few categories:

- No Sales Tax States (5 states): Five states impose no general sales tax at all on goods or services: Alaska, Delaware, Montana, New Hampshire, and Oregon. If you operate only in these states, you generally won’t charge sales tax on services (or anything else), because the state has no sales tax to begin with.

- States Taxing All (or Most) Services (4 states): Four states – Hawaii, New Mexico, South Dakota, and West Virginia – broadly tax services by default. These states’ sales tax laws are very inclusive: most services are taxable unless specifically exempt. If you’re in one of these states, you likely must charge sales tax on nearly all services you provide (with only a few carve-outs defined by law).

- States Taxing Some Services (the majority of states): The remaining 41 states (and D.C.) do not automatically tax services, but they each tax certain enumerated services. In these states, services are generally exempt unless the law specifically makes them taxable. However, every state’s list of taxable services is different. For example, one state might tax lawn care and gym memberships, while another only taxes services like car repairs or hotel accommodations. This patchwork causes a lot of confusion for service businesses operating in multiple states.

How States Tax Services

The chart above shows the number of states in each category. Only 4 states tax all services by default, whereas 41 states tax some services (those specifically listed in their laws). Meanwhile, 5 states have no sales tax on goods or services at all. This means if you’re providing services across state lines, you need to check each state’s rules. For instance, New York generally exempts most services, taxing only certain categories, while Texas taxes many common services such as property maintenance, amusement admissions, and data processing. Understanding where your services fall in each state’s tax scheme is critical.

In summary, sales tax may apply to services – but only in some places and for some types of services. Always verify the specific state law. Many states publish lists of taxable services (and exemptions) on their Department of Revenue websites. If you’re unsure, the next sections will help clarify how to determine if your service is taxable.

Do services require sales tax?

If you provide a service, when are you required to collect sales tax? The simple answer: only if your service is taxable in that state (and you have sales tax nexus in that state). “Nexus” just means a sufficient business presence (such as location or sales volume) that obligates you to comply with that state’s tax laws. Assuming you do have to follow a state’s rules, you need to know whether your service is on the taxable list.

Here are some guidelines to determine if your service requires charging sales tax:

- Check State Taxability Lists: Look up your state’s guidelines on taxable services. States often enumerate categories of services that are taxable. For example, Texas defines 17 categories of “taxable services” ranging from amusement services to data processing. Texas explicitly requires sales tax on services like car repairs, building cleaning (janitorial services), landscaping, amusement admissions, data processing, etc… If you provide one of these listed services, you must charge sales tax to customers in Texas. On the other hand, services not listed (e.g. legal consulting) are not taxed, so no sales tax is required on those.

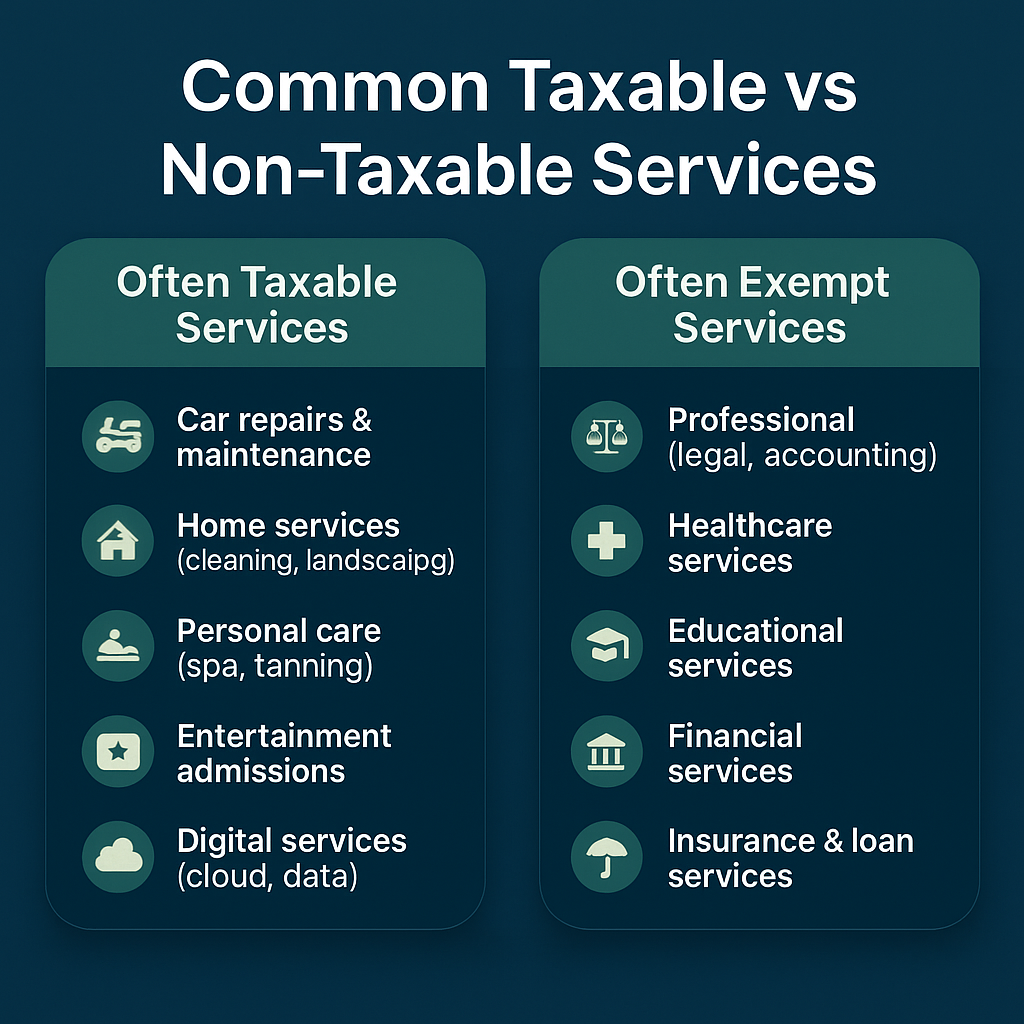

- Common Taxable vs Exempt Services: In general, personal and maintenance services are more likely to be taxable, whereas professional and medical services are usually exempt. For instance, many states tax services that relate to maintaining property or providing entertainment (think car repairs, cleaning services, lawn care, salon/spa services, tickets to events). In contrast, services like legal advice, accounting, medical treatment, and education are commonly exempt from sales tax. The graphic below highlights some typical examples:

Common Taxable vs. Non-Taxable Services

As shown above, services such as auto repairs, home cleaning or landscaping, personal care (e.g. spa or tanning services), entertainment admissions, and digital services are often subject to sales tax in states that tax services. Conversely, professional services (legal, accounting), healthcare, educational services, financial and insurance services are usually exempt from sales tax. (There are exceptions, but generally professional and knowledge-based services are the least taxed category due to long-standing exemptions.)

Products vs. Services Distinction

- Sometimes the taxability depends on whether your work results in a tangible product. If your service includes delivering a physical item, the state might treat it as a taxable sale of property. For example, in New York a photography shoot (the service of taking photos) is not taxable by itself, unless you deliver physical prints or storage media, in which case the tangible product (the photographs) is taxable. Always consider if there’s a tangible component to your service that might trigger tax.

- Some states publish specific publications or rulings. Florida, for instance, broadly exempts services but taxes a few (like security services). Maryland generally exempts services. Knowing these nuances will tell you if you need to register and collect tax for your service.

Follow State Guidance

In short, a service requires sales tax collection only if state law says the service is taxable. When it is taxable, you are required to register for a sales tax permit and charge the applicable sales tax to your customers, just as retailers do for products. When a service is not taxable, you should not charge sales tax (charging tax when not required could put you at a competitive disadvantage or require later refunds). The onus is on you as the business to get this right. It’s wise to consult a tax professional or use a taxability lookup tool if you operate in many states, as service tax rules can be quite detailed.

Should sales tax be charged on services?

After learning all the variations, you might be asking, so, should I charge sales tax on my services or not? The honest answer is “It depends.” As Avalara notes, whether you should charge sales tax on services entirely depends on the state and the type of service. Here’s a step-by-step thought process to determine your course of action:

- Identify the Service and Location: What service are you providing, and in what state(s) are you providing it? Sales tax is generally governed by the state where the service is delivered or used. Always start with the location factor.

- Check if the Service Is Taxable in that State: As discussed, consult that state’s tax regulations. Is your service category listed as taxable? For example, if you’re a web designer in Texas, many of your services (like data processing or creating a website) might be taxable under Texas law, so you should charge sales tax. But if you’re a web designer in New York, most design and consulting services would be exempt, so you should not charge sales tax on your design fees (New York taxes very few services, and specifically exempts custom design/consulting). Only charge sales tax if the law requires it for that service.

Play it safe and Document and Separately State Taxable Charges

- When part of your service is taxable and part is not, you may need to separate the charges. For instance, a contractor might charge for materials (taxable) and labor (often exempt for real property improvements). In states like New York, an advertising agency might not tax their creative services but would tax any tangible goods sold to the client. Always separate taxable and non-taxable items on invoices. This way, you charge tax only on the taxable portion.

- If you’re unsure and the state’s guidance is unclear, consider reaching out to the state’s Department of Revenue or a sales tax expert. Charging tax when not needed can be corrected (by refunding customers), but not charging tax when you should have can lead to liabilities later. It’s safer to charge when in doubt and simultaneously seek clarification, than to ignore a potential tax obligation.

Stay Updated

- Laws change. What’s exempt today might become taxable tomorrow (states often expand sales tax to new services over time). Keep an eye on legislative updates or tax bulletins in the states where you do business. For example, in recent years more states have started taxing digital services and SaaS (Software as a Service), which were historically exempt. Regular check-ins will ensure you continue to charge (or not charge) correctly.

Ultimately, you should charge sales tax on services only when required by law. When required, it’s not optional – failing to collect the tax means you could be on the hook for it yourself in an audit. When not required, charging tax would unnecessarily inflate your price to customers. Knowing the rules is key. If navigating this on your own feels overwhelming, consider seeking professional assistance. (In fact, Gnesist offers a specialized Sales Tax Filing Service to help businesses handle these complexities – more on that later.)

Gnesist Offers White Glove Sales Tax Support for Businesses Across All 50 States

Complying with sales tax for services across multiple states can be daunting – but you don’t have to do it alone. Gnesist is a Texas-based firm specializing in sales tax compliance, and we offer a white-glove sales tax service covering all 50 states. Being based in Texas (a state with notoriously complex service tax rules), we have first-hand expertise navigating tricky situations like those described above. Our team stays up-to-date on each state’s latest tax law changes, ensuring that your business charges the right tax on the right transactions.

Professional Sales Tax Filing Service

Sales tax compliance can be complex, especially if your business operates across multiple states. Our comprehensive sales tax filing service streamlines your tax filings, keeping them accurate, timely, and stress-free.

How Gnesist can help

We provide end-to-end assistance, from determining taxability of your services in each state, to obtaining necessary permits, to preparing and filing the returns. For example, if your business provides services online to customers in New York, Florida, and Texas, we help you figure out which of those states require sales tax on your specific services (and at what rate), then help you register and file correctly in each state. We pride ourselves on a “white glove” approach – meaning we handle the heavy lifting and offer personalized support, so you can focus on running your business rather than decoding tax statutes.

Frequently Asked Sales Tax Questions By Gnesist Clients

Every business has unique questions about sales tax on services. Here we address some frequently asked questions and scenarios that often come up:

Infrastructure as a Service (IaaS) Sales Tax

Do cloud infrastructure or IT services incur sales tax? – It depends on the state. Some states treat cloud-based services (IaaS, PaaS, SaaS) as taxable “data processing” or information services, while others do not tax electronically delivered services. For example, Texas considers certain web development and IT services as taxable data processing – a Texas ruling noted that creating and hosting a website is taxable in Texas. In contrast, states like Wyoming explicitly exempt infrastructure-as-a-service if no tangible property is transferred. Always check the state’s stance on digital services: about half of the states tax some form of software/IT service.

What services are subject to sales tax in New York?

New York generally exempts most services from sales tax, with some notable exceptions. Taxable services in New York include services to tangible personal property (e.g. repairing a car or equipment), services to real property (like landscaping or pest control), certain information services, and amusement/recreation services (like gym memberships or amusement park admissions). Additionally, New York City has its own local tax on certain services (e.g. beauty salon services within NYC). If your service doesn’t fall under a specifically taxed category (and isn’t a utility or restaurant service), it’s likely not subject to NY sales tax.

What services are exempt from sales tax in Texas?

Texas taxes many services, but not all. Services not listed among Texas’s taxable services are generally exempt. For instance, professional services (legal, accounting, consulting) are exempt – Texas does not levy sales tax on those. Advertising services are also not taxable in Texas (as long as you’re selling intangible ad services and not physical goods). Other examples of exempt services in Texas include medical services, education, insurance, real estate services, and interest on loans (these are outside the sales tax scope). In short, Texas provides a laundry list of 17 taxable service categories; if your service isn’t on that list, no sales tax is charged. (Always double-check the list, because it’s quite comprehensive, covering everything from cable TV to waste collection.)

Is there sales tax on photography services in New York?

Generally, no – the service of photography (taking photographs) is treated as a professional service and is not subject to NY sales tax. New York tax law makes a distinction: if the photographer sells tangible prints or images on physical media, those sales are taxable as tangible property. However, if the photos are delivered digitally (electronically) or simply as a service (no physical item given to the client), New York does not impose sales tax. So a photography session fee would not be taxed, but if you also sell an album or printed portraits in New York, you would charge sales tax on the price of those physical items.

Are advertising services subject to sales tax in New York State?

No, advertising services are not taxable in NY. New York specifically exempts advertising services, which include the creation of ads and placement of advertising in media. For example, if an advertising agency develops an ad campaign for a client and coordinates running those ads on TV or online, the service fees are not subject to sales tax. (If the agency sells any physical property as part of the deal – like printing posters or banners – those tangible items would be taxable, but the service of creating the ad is tax-exempt in NY.)

Maryland design services sales tax

Maryland generally does not tax services. Services in Maryland are exempt unless specifically listed, and Maryland’s list of taxable services is very short (mostly utility-type services and fabrications). Design services – such as graphic design, interior design, web design – are exempt from Maryland sales tax. If you provide design consulting in Maryland, you typically do not charge sales tax on your fees. (Maryland’s few taxable services are things like property maintenance, some telecommunication services, etc., which do not include design work.)

Arizona design services sales tax

Arizona, like many states, does not tax most service businesses. Arizona’s transaction privilege tax (TPT) taxes certain activities (like retail sales, contracting, job printing) but pure services (including design services) are usually not taxed. For example, an independent graphic designer or interior designer in Arizona would not charge sales tax on their design labor. Arizona does tax a few services (such as amusement, personal property rentals, and job printing), but general design/consulting services are not among those. Thus, design services are typically sales-tax free in Arizona.

Do you pay sales tax on services in Florida?

Mostly no. Florida is known for taxing very few services. In Florida, sales tax mainly applies to goods, and only a handful of services (like commercial cleaning services, security services, and nonresidential pest control) are taxable. The vast majority of services – from haircuts to legal services – are exempt from Florida sales tax. So unless your service is one of Florida’s special taxed services, you generally do not charge sales tax on services in Florida.

Sales tax on a moving company service in Michigan

Michigan does not impose sales tax on services in general. Michigan’s sales tax is limited to tangible products (and some digital goods) – services are outside its scope. Therefore, a moving company in Michigan would not charge sales tax on moving services. The customer is paying for the service of transportation of personal property, which Michigan does not tax. (If the moving company sells boxes or packing supplies as a separate sale, those goods would be taxable, but the service of moving is not.)

Does Arizona charge sales tax on services?

As mentioned earlier for design services, Arizona generally does not charge sales tax on most services. Arizona’s tax (TPT) is focused on certain business activities like retail sales, contracting, restaurants, etc. Pure services (consulting, personal services, etc.) are usually exempt. Only a few service-type activities are taxed under specific categories (for instance, amusement services, rental of equipment, and job printing are taxed under Arizona law). If your service doesn’t fall into one of those taxable categories, Arizona will not require you to collect tax on it.

Does sales tax apply to services in Texas?

Yes, Texas applies sales tax to many services. Texas is one of the more aggressive states in taxing services. It has 17 broad service categories that are taxable by law. This includes services like repairing tangible personal property (e.g. appliance repair, car repair), real property services (landscaping, janitorial, pool cleaning), amusement services (sporting event admissions, amusement parks), data processing and information services, telecom services, and more. If you are providing a service in Texas, you should carefully review the Texas Comptroller’s list of taxable services. Many common business services (marketing, consulting, etc.) might be exempt, but many others require charging the 6.25% state sales tax (plus local tax). When in doubt, check Texas’s Tax Code §151.0101 for taxable services.

Is there sales tax on cleaning services in Texas?

Yes. Texas specifically taxes “janitorial and custodial services”, which covers most cleaning services for real property. Whether you’re cleaning homes or offices, those services in Texas are taxable. (An exception exists for one-time residential cleaning under $5,000 as part of a broader remodeling project, but generally ongoing cleaning is taxed.) So, a Texas cleaning or maid service must charge sales tax to its customers. Texas even clarifies that related services like carpet cleaning, pool cleaning, and yard maintenance are taxable as real property services.

When to charge sales tax in Tennessee for handyman services

Tennessee does not broadly tax services, but it does tax labor that results in a taxable tangible product. For handyman services, the taxability can depend on what is being done:

- If a handyman in Tennessee is repairing tangible personal property (say, fixing appliances or equipment), that labor is taxable as part of the repair service (since Tennessee taxes services to tangible property).If the handyman is working on real property improvements (fixing a fence, patching drywall), generally that labor is not subject to sales tax in TN (Tennessee taxes sales of goods and a few services, but not typical home repair labor).

In summary, charge sales tax in Tennessee for handyman services only when the service is to tangible personal property (e.g. appliance repair labor). For general handyman labor on real property, no sales tax is charged in TN.

Can I charge sales tax for carpentry services?

It depends on the context and state. Carpentry can fall into different categories:

- Real property carpentry (construction) – Building or installing something that becomes part of real estate (framing a house, installing cabinets) is usually treated as a real property improvement. In most states, the labor for real property construction is not subject to sales tax; instead, the contractor pays tax on materials. So if you’re a carpenter framing a house, you typically wouldn’t charge sales tax on your labor to the client (except in states like New Mexico that tax all services).

- Creating tangible personal property – If a carpenter makes a piece of furniture or a custom item in their shop and sells it to a customer, that’s a sale of tangible personal property, and sales tax should be charged on the price of the item (since it’s essentially a product sale, even though it’s custom-made). Some states consider certain custom fabrication labor taxable. For example, some states tax “fabrication or manufacturing labor” applied to create a product for sale. Carpentry services that result in a movable item could fall under that in those states.

Many states specifically exempt carpentry or construction labor on real property. But a few, like Hawaii or New Mexico, would tax even services like carpentry because they tax virtually all services. So, charge sales tax on carpentry services if you are producing a tangible product for sale, or if you’re in a state that taxes services broadly. Otherwise, for typical contractor work on site, you usually do not charge tax on labor (only on materials if separately billed).

Sales tax on professional services

Nearly all states exempt professional services (such as those provided by attorneys, doctors, accountants, architects, consultants). Professional services are the least likely to be taxed, thanks in part to strong lobbying and the difficulty of taxing expertise-based services.

So if you’re asking about services like legal advice, medical treatment, engineering consulting, etc., the answer is that sales tax is almost never charged to clients for those services. There are rare exceptions – for example, South Dakota and New Mexico’s broad tax might catch some professional services, and Hawaii taxes most services (including some professional) with few exemptions. But in the vast majority of states, no sales tax applies to professional services. Always verify state law, but it’s a safe bet that if you’re invoicing for your time and expertise (with no tangible product in the mix), sales tax is not required.

These FAQs cover many common concerns. Remember, for any specific scenario, double-check the latest state regulations or consult a tax advisor, since laws can change and individual circumstances vary.

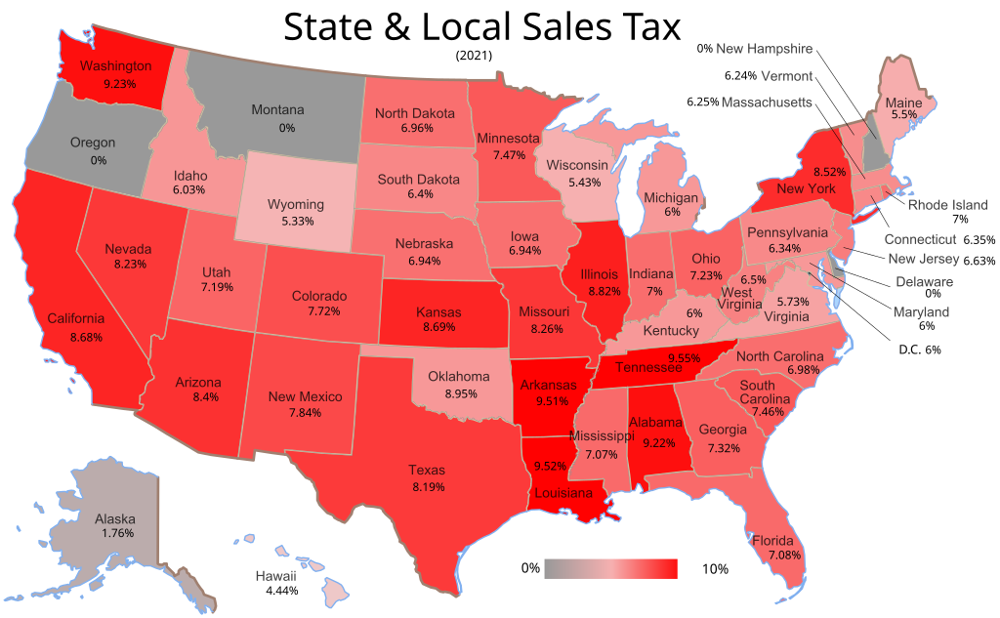

Sales Tax Rates Vary by State

The map above (2021 data) shows combined state & local sales tax rates across the U.S., illustrating how diverse the sales tax landscape is. Some states (marked in grey) have 0% tax, while others in red have high rates over 9%. This diversity in rates is matched by diversity in rules for services. Gnesist’s deep knowledge of all state tax regimes means we can guide you through which services are taxed where and at what rates. We function as an extension of your team to ensure full compliance in every state you operate.

If you’re looking for peace of mind and expert handling of your sales tax obligations, consider leveraging Gnesist’s experience. Our sales tax filing service is designed to be comprehensive and customized. Whether you are a small business in one state or a growing company selling services nationwide, we provide the hands-on support you need to manage sales tax for services correctly – so you never have to worry about surprise tax bills or audits. Reach out to Gnesist for a consultation, and let us help simplify sales tax compliance for your service business.

Conclusion

Navigating sales tax for services might seem complex, but with the right knowledge (and the right partner), you can master it. Remember to always check your state’s rules, charge tax when required, and keep good records. We hope this guide has demystified the process and given you the ultimate how-to on sales tax for services. Good luck, and happy selling!

Professional Sales Tax Filing Service

Sales tax compliance can be complex, especially if your business operates across multiple states. Our comprehensive sales tax filing service streamlines your tax filings, keeping them accurate, timely, and stress-free.