A Simple Guide on How to Master Small Business Tax Planning

Did you know that small business tax planning is more critical than ever with upcoming tax law changes? The 20% Qualified Business Income (QBI) deduction for pass-through entities is set to expire after December 31, 2025. Also, the top marginal tax rate will jump from 37% back up to 39.6% in 2026. These looming changes mean tax planning for business owners isn’t just a year-end task—it’s a year-round necessity. Yet many entrepreneurs still leave thousands of dollars on the table simply because they don’t have a solid tax strategy in place.

Tax planning for business owners

is all about being proactive. Whether you’re struggling with complex deductions or looking to maximize your tax savings, this comprehensive guide will walk you through proven business tax planning strategies to keep more money in your business. From leveraging the current $1,250,000 Section 179 deduction to optimizing the 67¢-per-mile business vehicle deduction for 2024, we’ll show you exactly how to reduce your tax burden legally and effectively. In fact, studies have shown that over 90% of business owners overpay on taxes – often by five figures annually – due to missed opportunities and mistakes. It’s time to change that.

Ready to master your small business taxes and potentially save thousands each year? Let’s dive into the small business tax planning strategies that can get you there.

Save money with Gnesist strategic tax planning

Strategic Tax Planning

Maximize savings, minimize liabilities, and achieve peace of mind with Gnesist’s Strategic Tax Planning services. We provide a proactive, personalized approach to tax planning that goes beyond basic preparation. Strategic tax planning means analyzing your finances year-round to legally reduce…

Understanding Small Business Tax Planning Fundamentals

Small business tax planning serves as the foundation for financial success, yet many entrepreneurs confuse it with basic tax preparation. Understanding this distinction is the first step toward saving significant money on your taxes.

What Makes Tax Planning Different from Tax Preparation

Tax planning is a proactive, year-round approach designed to minimize your tax liability, while tax preparation is merely the act of compiling forms and filing returns during tax season. According to tax professionals, tax planning focuses on forward-thinking financial decisions and strategies that reduce your business’s tax burden over time. In contrast, tax preparation centers around compliance – making sure your returns are accurate and filed on time.

The difference is significant: effective small business tax planning provides financial clarity for your business and frees up capital for reinvestment, potentially saving you thousands in the long run. Meanwhile, tax preparation simply ensures you’re following the rules when filing. Think of tax planning for business owners as mapping out a journey to pay less tax, whereas tax prep is just recording where you’ve been.

Key Tax Forms Every Small Business Owner Should Know

Your business structure directly determines which tax forms you’ll need to file. The IRS reports that business taxes fall into five general categories: income tax, estimated taxes, self-employment tax, employment taxes, and excise tax. Each type of tax has associated forms:

- Sole Proprietors & Single-Member LLCs: File Form 1040 with Schedule C to report business profit or loss.

- Partnerships & Multi-Member LLCs: File Form 1065 (partnership return) and issue K-1s to partners for their shares of income.

- S-Corporations: File Form 1120-S and issue K-1s to shareholders.

- C-Corporations: File Form 1120.

- Employers: File Form 941 (quarterly payroll tax returns) and Form 940 (annual unemployment tax) if you have employees.

- Estimated Taxes: If you expect to owe $1,000 or more in income taxes for the year, make quarterly estimated tax payments using Form 1040-ES (for individuals/self-employed) or Form 1120-W (for corporations).

Understanding which forms apply to your business prevents costly mistakes. For example, filing the wrong type of return or missing a required form can lead to penalties and missed deductions. Always confirm your business entity classification and ensure you’re filing the correct returns for that structure.

Common Tax Mistakes That Cost Small Businesses Thousands

Several major errors consistently drain small business profits and can derail your business tax planning:

- Poor Recordkeeping: Failing to maintain accurate, complete records leads to missed deductions and raises red flags in audits. In fact, many owners lose significant money simply through disorganized bookkeeping and “shoebox” accounting practices. If expenses and income aren’t tracked properly, you can’t claim all of your eligible write-offs.

- Missing Deductions and Credits: Not taking advantage of all available deductions and tax credits is essentially leaving free money with the IRS. The tax code is full of incentives for business owners – from the home office deduction to R&D credits – but you must know about them to use them. A lot of tax planning strategies focus on identifying every deduction you qualify for.

- Mixing Personal and Business Finances: Blurring the line between personal and business expenses creates confusion and may disqualify legitimate deductions. The IRS is strict about business owners separating personal and business finances. If you mix accounts, it becomes difficult to prove what’s business-related, and you risk losing deductions (or worse, “piercing the corporate veil” which can expose your personal assets). Always use a dedicated business bank account and credit card for business transactions.

Common mistake: Not understanding which sales are subject to state sales tax. The infographic above shows examples of services often taxable vs. non-taxable, highlighting another area where small businesses can err in tax compliance.

By recognizing and correcting these fundamental mistakes, you set the groundwork for effective small business tax planning that can save your business thousands annually. Next, we’ll look at how to plan out your tax strategy over the course of the entire year.

Creating Your Annual Tax Planning Calendar (for Business Owners)

Time management is at the heart of effective small business tax planning. Creating a structured annual tax calendar helps you avoid last-minute scrambles and ensures you maximize every available tax advantage throughout the year. In other words, tax planning for business owners should be an ongoing process, not a one-time event.

First Quarter Tax Planning Priorities

January through March sets the foundation for your entire tax year. Start by organizing all financial documents from the previous year, including income statements, expense receipts, and balance sheets. This gives you a clear snapshot of your finances and helps identify potential deductions early on (e.g. large purchases that might be depreciable).

Next, establish a tax calendar with key deadlines and tasks. Mark important due dates: for instance, January 15 is the due date for the fourth-quarter estimated tax payment (for the prior year) if you’re self-employed or expect to owe more than $1,000. Likewise, note March 15 (Partnership and S-Corp tax filing deadline or extension) and April 15 (personal and C-Corp filing deadline, and first-quarter estimated payment due). By planning for these dates, you won’t be caught off guard by a sudden cash outflow or paperwork rush.

Early in the year is also the perfect time to separate any personal expenses that got mixed into your business accounting during the prior year. Clean books ensure that only legitimate business expenses will be deducted, protecting your deductions. Additionally, review last year’s tax return for any deductions or credits you might have missed so you can capture them going forward.

Mid-Year Tax Checkup Essentials

Summertime (around June or July) is ideal for a thorough mid-year tax review. A mid-year checkup helps prevent end-of-year surprises and uncovers opportunities to adjust your business tax planning strategies while there’s still time to act. During this checkup, do the following:

- Year-to-Date Income & Expenses: Evaluate your year-to-date profit. Are you on track to earn significantly more or less than last year? Big changes in income might call for adjusting estimated tax payments or withholding.

- Estimate Tax Liability: Roughly calculate your taxable income so far and project it for the full year. This can reveal if you’re likely underpaying or overpaying taxes and if you should adjust quarterly payments.

- Life Changes: Consider any personal or business life changes (marriage, divorce, new child, new property, etc.). Major changes can impact your tax situation through credits, deductions, or filing status.

- Retirement Contributions: If you have a retirement plan (like a SEP IRA or 401(k)), check how much you’ve contributed so far. Mid-year is a great time to increase contributions to reach the annual max and lower taxable income.

- Flexible Spending Accounts (FSAs): If you use an FSA for healthcare or dependent care, ensure you’re on pace to use those funds (since most FSAs are “use it or lose it” by year-end).

By mid-year, you also want to verify that your tax strategy implementation is on track: Are you keeping up with logging mileage, saving receipts, and other tasks that were easy to start in January but easy to slack on by June? A mid-year audit of your own processes can keep your tax planning disciplined.

End-of-Year Tax Moves That Save Money

The final quarter (October through December) is your last chance to implement tax planning strategies before the year closes. This is when you should pull out all the stops to legally lower your tax bill. Consider these effective end-of-year tactics:

- Accelerate Expenses: Plan needed business purchases before December 31 to deduct the expenses this year. For example, stock up on office supplies or invest in new equipment now (rather than next January) so you can claim the deduction.

- Defer Income: If possible, delay invoicing clients until late December so that receipt of payment falls in January of next year, thus deferring the taxable income (we’ll discuss more on deferral soon).

- Charitable Contributions: The holiday season is a great time to make tax-deductible donations if your cash flow allows. Gifts to qualified charities by Dec 31 can lower your taxable income.

- Maximize Retirement Contributions: Ensure you contribute the maximum to retirement plans. For instance, if you have a Solo 401(k), contribute the employee portion by Dec 31. Every additional dollar put into a pre-tax retirement account is a dollar off your taxable income.

- Year-End Cleanup: Conduct a thorough balance sheet reconciliation and catch up on any bookkeeping discrepancies. Identify any bad debts to write off. Ensure you’ve recorded all asset purchases and expenses.

Professional Help From An Accountant

Finally, meet with a tax professional or accountant in Q4 if possible. A year-end tax planning session with your CPA can uncover last-minute moves like making an S-corp election effective Jan 1, or deciding whether to elect bonus depreciation on a new asset. They can also help determine if taking a filing extension or other strategy might benefit you.

Remember, successful small business tax planning requires continuous attention throughout the year, not just a frantic push during tax season. By following an annual calendar and adjusting each quarter, you’ll minimize stress and maximize savings.

Assessing Your Current Tax Situation

Before implementing any advanced strategies, you need a clear picture of where your business stands tax-wise. Assessing your current situation creates the baseline for making informed decisions that can ultimately save you a lot of money.

Calculating Your Effective Tax Rate

Your effective tax rate is the actual percentage of your taxable income that you pay in taxes, and it often differs from your marginal tax bracket. For small business owners (especially pass-through entities), calculating this rate provides crucial insight into your overall tax burden.

To determine your effective tax rate:

- Add up all taxes paid for the year (including income tax self-reported on your 1040, self-employment tax, etc.).

- Divide that total tax by your taxable income.

- Multiply by 100 to get a percentage.

For sole proprietors, LLCs, and S-Corps, remember that the effective rate should include both income tax and self-employment tax (15.3% for Social Security/Medicare on applicable income). For a C-Corp owner, consider the 21% corporate tax plus any personal tax on salary or dividends taken out. Many business owners are surprised by their effective rate – it often illustrates how self-employment tax and other factors push the real rate higher than expected.

Knowing this percentage helps set the stage for tax planning strategies. For example, if you find your effective tax rate is, say, 25%, you’ll be motivated to utilize strategies that can bring that number down next year (like increasing deductions or retirement contributions).

Identifying Your Biggest Tax Pain Points

Take a hard look at what aspects of your business tend to create tax challenges or “pain points.” Most small businesses face at least a few common issues:

Quarterly Estimated Taxes

- Many owners struggle with making quarterly tax payments. If you miss these or underpay, you’ll incur penalties and interest. A pain point might be not setting aside enough cash throughout the quarter for these payments. (Pro tip: Aim to set aside ~30% of your profit for taxes so you’re not caught short when estimates are due.)

Payroll Taxes and Withholding

- Employment taxes can be complex and easy to mess up. For 2024, Social Security tax applies up to $168,600 of wages, and there’s an additional 0.9% Medicare surtax on high earners. Ensure you’re calculating and depositing payroll taxes correctly. Misclassification of workers (employee vs contractor) is another source of pain.

Sales Tax or Excise Tax Compliance

- If your business sells taxable goods or services, keeping up with state and local sales tax rules can be burdensome. This might not affect federal income taxes, but it’s a tax issue that can hit cash flow if not managed.

Recordkeeping Problems

- As mentioned earlier, poor recordkeeping is a primary culprit for overpaying. If your books aren’t up-to-date, you might be missing expenses or, conversely, mis-characterizing personal expenses as business. The IRS specifically warns against mixing personal and business expenses for this reason.

Unrealized Credits/Incentives

- Perhaps you’re not taking advantage of specific tax credits (like a credit for starting a retirement plan, R&D credits, etc.). Identifying these as pain points means there’s an opportunity to save if you address them.

Write down the top 3–5 tax-related challenges you face. These are the areas your tax planning efforts should prioritize. For instance, if making quarterly payments is a pain point, one strategy might be to increase your withholding through payroll (if you take a salary) to cover taxes instead of relying on big quarterly outlays.

Setting Realistic Tax Savings Goals

Effective tax planning for business owners includes setting specific, measurable goals for tax savings. Start by reviewing your financial records in detail: income, expenses, cash flow, and debt. This gives you a realistic baseline. Then consider goals such as:

- Increase deductions by X%: If you deducted $50k in business expenses last year, aim to legitimately increase that to, say, $60k this year by capturing more small expenses, or investing in new equipment, etc.

- Maximize the QBI Deduction: If you’re eligible for the 20% QBI deduction on pass-through income, ensure you qualify for the full amount each year through 2025. For example, if you’re an S-Corp, paying yourself a “reasonable salary” that isn’t too high can maximize QBI (since QBI is taken on the profit, not on W-2 wages from the S-Corp).

- Retirement Contributions: Plan to contribute a certain amount to tax-advantaged retirement accounts. For instance, set a goal to contribute the maximum $70,000 to a Solo 401(k) (if your income allows) or a set percentage of profits to a SEP IRA.

- Utilize an HSA or Other Plans: If you have a high-deductible health plan, contribute the max to a Health Savings Account. It’s an above-the-line deduction and can cover medical costs tax-free. Or use a 529 plan for education savings if that fits – some states give deductions for those.

- Lower Effective Tax Rate: Perhaps your goal is to reduce your effective tax rate from 25% to 20% next year. This could be achieved by combinations of the above strategies – more deductions, retirement contributions, and business credits.

Set Concrete Tax Saving Goals

Make sure your goals are realistic given your business size and income. It’s also wise to revisit them annually. As your business grows or tax laws change, adjust your targets. The key is that you’re not just planning nebulously to “save on taxes” – you have a concrete plan, like “save $X in taxes by doing Y,” which you can execute and track.

Setting goals turns abstract tax planning into a concrete part of your business strategy and gives you benchmarks to measure success.

Maximizing Business Expense Deductions

One of the most important business tax planning strategies is ensuring you take every deduction you’re entitled to. Proper documentation and a little strategizing can save your business thousands each year in taxes. Below we outline key areas to focus on:

Tracking Expenses Effectively Year-Round

Successful small business tax planning begins with a robust recordkeeping system. The IRS requires you to keep supporting documents for your income and expenses – invoices, receipts, canceled checks, bank statements, etc. Keeping these organized by category (travel, utilities, supplies, etc.) makes life much easier at tax time and substantiates your deductions in case of an audit.

Consider using accounting software or apps that automatically categorize transactions. Many modern bookkeeping tools can link to your bank and credit card accounts and help flag transactions as business-related. This not only speeds up tax preparation but also helps you spot deductible expenses you might otherwise overlook. Review your expense categories monthly to ensure everything is categorized correctly.

Finally, don’t wait until year-end to tally up receipts. Maintain a habit (perhaps quarterly or monthly) of reviewing expenses and noting which are fully deductible, partially deductible (like 50% business meals), or non-deductible. Consistent tracking is the only way to confidently maximize deductions without scrambling through a pile of receipts on April 14th.

Home Office Deduction: Rules and Requirements

If you operate your business from home (even partly), the home office deduction can be a significant money-saver. To qualify, you must use a part of your home exclusively and regularly for business. This means a dedicated space used only for work – not the dining table that doubles as your desk.

There are two methods to calculate the home office deduction:

- Simplified Method: Deduct a flat $5 per square foot of your home office space, up to 300 square feet (max $1,500 deduction). This is straightforward – no need to calculate actual utility or rent percentages. It works well for small home offices.

- Regular Method: Calculate the percentage of your home’s square footage used for business, then apply that percentage to actual expenses. Eligible expenses include a portion of rent or mortgage interest, property taxes, homeowners insurance, utilities, repairs, and depreciation. For example, if your office is 10% of your home’s area, you can deduct 10% of those household costs.

Keep in mind, under either method, the home office deduction cannot exceed your business’s net income (it won’t create a loss). Also, if you use the regular method, any excess expenses beyond the income limit can carry over to the next year.

The home office is often a missed deduction because people fear it’s an audit trigger. In reality, if you legitimately qualify, you should take it. Just be sure you meet the exclusive use test and keep records (like a simple diagram of your workspace with dimensions and copies of household bills).

Vehicle and Travel Expense Strategies

Many small business owners use a personal vehicle for business purposes – this can yield substantial deductions if handled properly. For business vehicle use, you generally have two deduction options:

- Standard Mileage Rate: Track your business miles and deduct a set rate per mile. For 2024, the standard mileage rate is 67 cents per mile. This method already factors in gas, maintenance, depreciation, and other vehicle costs – you can’t deduct those separately if you use the mileage rate. It’s simple if you drive a lot for business; just keep a log of business miles (noting dates, mileage, and purpose of trip).

- Actual Expense Method: Deduct the business-use percentage of all actual vehicle expenses. This includes gas, oil changes, repairs, insurance, registration, and depreciation. For example, if 60% of your vehicle’s mileage in a year is for business, you can deduct 60% of those total costs. You’ll need to keep detailed receipts for all expenses and maintain records of total mileage vs business mileage.

Compare Deductions To Maximize Savings

Choose whichever method gives the larger deduction. Often, new or luxury vehicles favor actual expenses (due to depreciation), whereas efficient or older cars might yield more from the per-mile rate. You can calculate both in the first year to see which is better (note: if you start with actual expenses and depreciate the car, you’re locked into actuals for that vehicle going forward).

Don’t forget other travel expenses: If your business requires overnight travel away from your tax home, you can deduct airfare, hotels, car rentals, 50% of meal costs, taxi/rideshare fares, baggage fees, and even dry cleaning while on business travel. The key is the trip must be primarily business-related. Keep receipts and records of the business purpose of the trip (meetings, conferences, client visits, etc.). If you tack on personal days to a trip, you can still deduct the portion related to business.

Technology and Equipment Deductions

Investments in technology and equipment can be a big part of your tax planning for business owners. The tax code offers generous provisions to write off these costs:

- Section 179 Expensing: Under Section 179, you can deduct the full purchase price of qualifying business property in the year it’s placed in service, rather than depreciating it over several years. As of 2024, up to $1,220,000 of equipment purchases can be expensed immediately (subject to income limitations). Qualifying property includes machinery, computers, office furniture, certain vehicles, and other tangible personal property used in business. If you need expensive equipment and have the income to absorb the deduction, Section 179 is extremely valuable.

- Bonus Depreciation: Even if you exceed Section 179 limits or choose not to use it, bonus depreciation allows an immediate deduction of a percentage of the asset’s cost. Currently, bonus depreciation is 60% for 2024, dropping to 40% in 2025 and 20% in 2026 (after which it sunsets). Unlike Section 179, bonus depreciation can create a net operating loss and has no dollar cap. It also applies to used property. This is great for large capital investments; just note the phasedown in coming years.

- De Minimis Safe Harbor: If you buy inexpensive items (e.g. less than $2,500 per item), you can elect to simply expense them as supplies or equipment in the year purchased, under the safe harbor for tangible property. This way you don’t have to depreciate trivial assets.

Keep a detailed fixed asset schedule for your business. This is a list of all significant equipment, furniture, and technology you own, including purchase dates and costs. It will help you and your accountant decide the best approach (Section 179 vs. bonus vs. regular depreciation) at tax time. Also, remember that if you lease equipment, lease payments are generally fully deductible as an expense.

Document, Document, Document!

Lastly, document the business use of all equipment. For example, if you buy a new laptop, but occasionally let your kids use it for school, technically you should only deduct the % used for business. Equipment used 100% for business provides the maximum write-off.

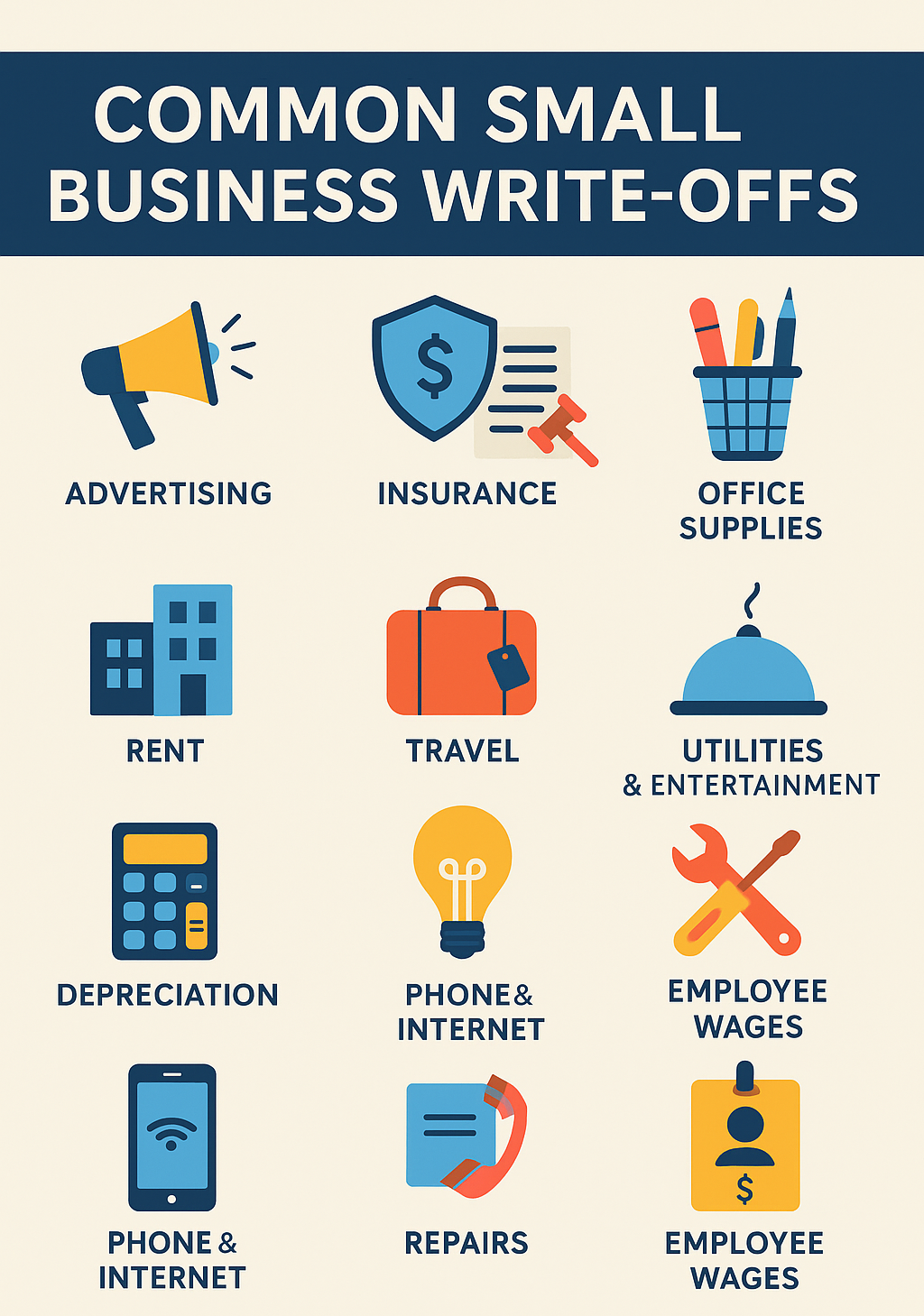

Common small business write-offs: The infographic above highlights many expenses that can be deducted, from advertising and insurance to rent and travel. Effective business tax planning ensures you’re taking advantage of all applicable write-offs like these.

By diligently tracking expenses and leveraging provisions like the home office, mileage rate, Section 179, and others, tax planning for business owners turns everyday spending into substantial tax savings. Every dollar deducted is money back in your pocket to reinvest in your business.

Smart Income Management Strategies

Strategically managing when and how your income is recognized can be a powerful tax planning strategy. Small business owners often have some control over the timing of income and expenses, especially if using cash-basis accounting. Here are ways to optimize income for tax purposes:

Timing Revenue Recognition for Tax Advantages

For small businesses on the cash method of accounting, income is taxable in the year it’s received (actually in hand or in your bank), not necessarily when earned. This creates opportunities to shift income between tax years. If you expect to be in the same or a lower tax bracket next year, deferring income can be beneficial. Conversely, if you anticipate higher taxes down the road (say, due to the 2026 rate hikes to 39.6% top bracket), you might accelerate income into the current year while rates are lower.

Some examples of timing strategies:

- Delay Invoicing: If late in the year, you can send invoices in late December such that clients pay in January (assuming that still suits your cash flow). This pushes the taxable income into next year. Be careful not to harm cash flow severely just for tax – balance is key.

- Accelerate Billing: In a year you want more income on the books (perhaps to qualify for a loan or because next year’s rates rise), invoice as early as possible and follow up on collections to pull income into the current year.

Keep in mind that accrual-basis businesses have less flexibility here since income is recognized when earned (regardless of when paid). However, even accrual businesses can sometimes defer certain receipts or adjust contract terms to affect the timing.

Proper income timing isn’t about evading tax; it’s about deferring or expediting what you legally owe to achieve the lowest overall tax over multiple years. Just remember, eventually the income will be taxed – you’re deciding which year’s tax it falls under as part of your tax strategy.

Deferring Income Techniques That Work

Deferring income to a later year can smooth out your taxable income and prevent “spikes” that push you into higher brackets. We mentioned delaying invoices – here are a few other business tax planning strategies to defer income or accelerate deductions at year-end:

- Hold Off on Customer Billing: As discussed, wait until late December to bill customers so their payments come in January. Make sure this doesn’t violate any contract terms about timing of invoices.

- Offer Holiday Discounts for January Deliveries: Encourage customers to schedule and pay for work in January by offering a slight discount or bonus for after-New Year business. That way, you shift revenue into next year while keeping customers happy.

- Utilize Deposits Properly: If a client pays a deposit for work that isn’t done yet, on cash basis you might not count it as income until the service is provided (depending on contract terms). Structuring some payments as refundable deposits or retainers could delay recognition.

- Expense Prepayments: The opposite side of deferral is accelerating deductions. For instance, you can prepay certain expenses in December (like a January rent or an insurance premium due early next year) and claim the deduction now, under the 12-month rule for cash basis (if the prepaid expense covers a period within 12 months).

- Credit Card Trick: Charges on a business credit card are deductible in the year charged (for cash-basis taxpayers), even if you pay the credit card bill next year. So you could put year-end expenses on the card in December, deduct them now, and actually pay for them in January, effectively getting a short-term float.

Deferring income works particularly well if you had an unusually good year and expect next year to be leaner or taxed more heavily. Just be cautious: don’t defer so much income that you struggle to pay bills or run into cash flow problems. Tax planning must always be balanced against business liquidity needs.

Managing Cash Flow While Optimizing Taxes

It’s important to state: Tax minimization should not completely override sound business operations. You must maintain healthy cash flow to run your business. Therefore, coordinate your tax planning for business owners with cash flow management:

- Keep a Cash Reserve: A good practice is to keep aside a 3-6 month cash reserve for expenses (including tax payments). This buffer lets you execute tax strategies (like accelerating expenses) without risking your ability to cover routine costs.

- Use Financing if Sensible: In some cases, short-term financing can help implement a tax strategy. Example: If you can buy a piece of equipment on December 30 and get a big deduction, but you’re short on cash, using a short-term business loan or line of credit to purchase it could make sense. The tax savings might outweigh a month of interest – but run the numbers.

- Avoid a Tax-Driven Cash Crunch: Don’t, for instance, defer so much income to next year that you can’t pay your employees or vendors this year. It’s better to pay a bit more tax this year than to incur late fees, damage relationships, or hurt your credit by not paying obligations.

- Plan for Estimated Taxes: If you do a lot of deferring of income into next year, remember that next year’s Q1 estimated tax (due April 15) may need to be higher. The IRS expects you to pay as you go. Use safe harbor rules (100% or 110% of last year’s tax, or 90% of current year’s) to avoid underpayment penalties.

In summary, integrate your tax planning strategy with your budgeting. Project your cash flows and see the impact of moves like buying assets or deferring revenue. Good planning ensures you minimize taxes and maintain the cash you need for operations.

By timing income and deductions wisely and keeping an eye on cash flow, you can significantly reduce your tax burden across years. This is sophisticated business tax planning in action – thinking ahead, rather than just looking in the rear-view mirror at last year’s taxes.

Building Wealth Through Tax-Advantaged Retirement Plans

Retirement plans offer a dual benefit: they help you save for the future and reduce taxes today. As a small business owner, you have access to some powerful retirement savings vehicles beyond the standard IRA or 401(k) that employees use. Choosing the right plan is a key part of tax planning for business owners looking to build wealth.

Solo 401(k) vs. SEP IRA: Choosing the Right Plan

Two of the most popular self-employed retirement plans are the Solo 401(k) and the SEP IRA. Both allow large contributions, but they have different rules and nuances:

- Solo 401(k): Also known as a one-participant 401(k), this plan is just for the business owner (and spouse, if involved). It lets you contribute in two ways – as the “employee” and as the “employer.” In 2025, you can contribute up to $23,500 as an employee (elective deferral), plus an additional $7,500 catch-up if age 50+. On top of that, your business can contribute up to 25% of your compensation as the employer, until the total of employee+employer contributions hits the limit (which is $70,000 for 2025). This dual contribution structure means potentially very high contributions if your income is sufficient. Solo 401(k)s can also offer Roth contributions (for the employee portion) and even loan provisions.

- SEP IRA: A Simplified Employee Pension (SEP) IRA is funded by employer contributions only. You can contribute up to 25% of your net self-employment earnings (or W-2 wages from the business if you have them), with a maximum of $70,000 for 2025 (the same overall dollar limit as the Solo 401k). SEP IRAs are easier to administer (often just opening an account at a brokerage), but they do not allow catch-up contributions for those over 50 and have no Roth option. One key consideration: if you have employees, a SEP requires you to contribute the same percentage for them as you do for yourself, which can get expensive. A Solo 401(k) by definition excludes non-owner employees, so it’s not an issue there.

Maximize Your Retirement

In short, if you’re a one-person business (or partnership with spouse) and want maximum flexibility, a Solo 401(k) often edges out the SEP because of the higher contributions at lower income levels and the Roth feature. If you have other employees, a SEP IRA might be simpler, unless you explore other options like a SIMPLE IRA or a traditional 401(k) plan.

Either plan can drastically reduce your taxable income. For example, if you have a $100,000 profit and you contribute $50,000 into a Solo 401(k), you’ll only pay tax on $50,000 (ignoring SE tax adjustments for simplicity). That’s a huge immediate savings and of course, you’re building your retirement nest egg.

Contribution Limits and Deadlines You Need to Know

Retirement plans come with important deadlines and limits that factor into your tax planning strategy:

- Annual Contribution Limits: As noted, for 2025 the combined limit for Solo 401(k) is $70,000 (or $77,500 if age 50+). For SEP IRAs, the limit is $70,000 (no catch-up, since contributions are employer-based). Traditional and Roth IRAs (not business plans, but personal) have their own limits ($6,500 with $1,000 catch-up for 2025, if eligible – these are separate from the above).

- Deadlines to Set Up the Plan: The SECURE Act 2.0 allows Solo 401(k)s to be established up until your tax filing deadline (including extensions) for the year after the tax year, and still make contributions for that tax year. For example, you could set up a Solo 401(k) in March 2026 before filing your 2025 return and still treat contributions as 2025 contributions. However, note: employee elective deferrals for a Solo 401(k) generally must be elected by 12/31 of the tax year, even if funded later. So if you want to max the employee $23,500 for 2025, you should document that deferral by end of 2025.

- Contribution Deadlines: For Solo 401(k), employee deferrals should ideally be deposited by 12/31 (or very early in January), and employer contributions by the business’s tax filing deadline (plus extension if applicable). For SEP IRAs, contributions for 2025 can be made up until your 2025 tax filing deadline including extensions (e.g., as late as October 15, 2026 for an individual on extension). This flexibility allows you to decide on the final amount once you know your exact income.

- SIMPLE IRAs & Others: If you have a SIMPLE IRA plan (for slightly larger small businesses, up to 100 employees), note that it has different limits (e.g., $15,500 employee deferral in 2023, plus catch-up; likely a bit higher by 2025) and must be set up by October of the prior year. We won’t dive deep into SIMPLEs here, but keep it in mind if SEP or Solo 401k aren’t suitable.

Contribute Throughout The Year As Part Of Your Tax Planning Strategy

From a planning perspective, these deadlines mean you often have until after year-end to actually put money in the plan (especially SEP). But don’t wait too long – the earlier you contribute, the sooner your money starts growing tax-deferred, and the more secure your retirement will be. A great tax planning strategy is to contribute steadily throughout the year, rather than scrambling to fund a SEP IRA right before filing.

In summary, leverage retirement plans to simultaneously cut your tax bill and invest in your future. It’s one of the few win-win strategies in tax planning: you’re not just “spending money to get a deduction,” you’re paying yourself by saving for retirement, and getting a deduction as a bonus.

Employee-Related Tax Strategies

If you have (or are considering) employees – even if it’s just your spouse or kids – there are clever ways to structure compensation that yield tax benefits for the business and sometimes for the employee. Tax planning for business owners should include how you pay yourself and others.

Tax-Efficient Compensation Methods

For those structured as S-Corporations, one classic strategy is balancing salary vs. distributions. S-Corp owners who work in the business need to pay themselves a “reasonable salary” as wages, which is subject to payroll taxes (Social Security/Medicare). Any additional profit can be taken as distributions, which are not subject to payroll taxes. By not overpaying yourself in salary, you legally minimize payroll tax. However, you must pay enough salary to be considered reasonable for your role, or the IRS can reclassify distributions as wages (and hit you with back payroll taxes and penalties).

Example: If your S-Corp earns $150,000 before owner comp, instead of taking $150k as W-2 wages, you might pay yourself, say, $80,000 salary and take $70,000 as a distribution. You’d pay Social Security/Medicare tax on the $80k (approximately $12k), but avoid those 15.3% taxes on the $70k distribution – saving over $10,000. This is a legitimate tax strategy as long as $80k is a reasonable salary for the work you perform (what you’d pay someone else with your duties). Finding that reasonable salary figure is the tricky part; consider your title, responsibilities, region, and use resources (even IRS guidelines or industry data) to justify it.

If you’re not an S-Corp, consider whether electing S-Corp status or forming an S-Corp could benefit you once your net profits are comfortably above, say, $40-50k. Below that, the hassle might outweigh payroll tax savings, but above that, the savings can be substantial.

For C-Corps, the dynamic is different (C-Corp profits are taxed at 21%, and wages are separate). In C-Corps, you actually want to maximize salary and benefits to reduce the corporate taxable income (so the corp doesn’t pay 21% on profits). Paying yourself a high salary in a C-Corp zeroes out the profit, leaving little to be taxed at 21%. Just don’t exceed reasonable comp there either, because unreasonable comp can be reclassified as dividends by the IRS (which would then not be deductible to the corp).

Bottom line: How you classify payments to owners can be a major tax planning lever. It’s worth discussing with a CPA to optimize owner compensation strategy for your entity type.

Hiring Family Members Strategically

Hiring your spouse, children, or other family members can create tax advantages when done correctly. For example, if you hire your under-18 child in your sole proprietorship or a partnership where both partners are parents of the child, their wages are exempt from Social Security, Medicare, and FUTA taxes.

That’s a tax savings for you as an employer (no payroll tax on those wages). Plus, the child likely pays little to no income tax on their earnings because of the standard deduction for dependents (which was $12,950 in 2022, and $14,600 in 2024). In effect, you’re shifting income from your higher tax bracket to your child’s zero or low tax bracket – keeping the money in the family while lowering overall taxes.

For instance, say you pay your 17-year-old $10,000 during the year to help with office work, social media, etc. That $10k is a business expense (deductible) to you. The child owes $0 in federal tax because $10k is under their standard deduction, and you’ve also avoided payroll taxes on that $10k. It’s a legit win-win (assuming the work and pay are legitimate – they must actually do work appropriate for their age, and you must pay a reasonable wage for that work).

If your child is 18-20, wages are exempt from FUTA (unemployment) tax, though Social Security and Medicare would apply. Above 21, they’re treated like any employee for payroll taxes. Even then, paying a family member still shifts income potentially to a lower bracket.

Be sure to do it by the book: put them on payroll, withhold taxes as required, and keep timesheets or job descriptions to substantiate their work. The IRS does scrutinize family employment if it looks fishy (e.g., paying a 7-year-old $30/hour to “consult” on marketing strategy would not fly).

Don’t forget your spouse: If you hire your spouse in your business, you generally have to pay payroll taxes on their wage, but it allows you to potentially provide benefits (like health insurance or retirement plan contributions) for them which are deductible business expenses. In some cases, covering a spouse under a group health plan through the business can allow the premium to be deductible when it might not be if paid personally.

Fringe Benefits That Reduce the Tax Burden

Fringe benefits are often overlooked in business tax planning strategies. Certain benefits you provide to employees (including yourself as an employee of your company) can be deductible to the business but not taxable to the employee – the holy grail of tax efficiency.

Examples of powerful fringe benefits and their tax treatment:

- Health Insurance: If you have an incorporated business (S-Corp or C-Corp), the company can generally deduct health insurance premiums, and employees get that coverage tax-free. S-Corp owners have to include premiums in wages (with a corresponding above-the-line self-employed health insurance deduction on their 1040), but rank-and-file employees get it tax-free.

- Qualified Small Employer HRA (QSEHRA) or ICHRA: These are ways small employers can reimburse employee medical expenses/premiums tax-free without a group plan. Useful if you have only a few employees.

- Retirement Plan Contributions: As covered, contributions to a qualified plan (401k, etc.) are not included in employee taxable wages (up to limits) but are deductible to the business.

- Section 125 Cafeteria Plan: Employees can pay certain expenses (like health premiums, some out-of-pocket medical, and dependent care) pre-tax through a cafeteria plan, saving payroll and income taxes. As an owner, you may or may not benefit depending on the plan and entity, but it’s great for employees.

- Education Assistance: You can pay up to $5,250 per year for an employee’s tuition or education costs (for job or even non-job-related education) tax-free to them, under a written educational assistance plan.

- Dependent Care Assistance: Up to $5,000 can be provided tax-free for childcare costs (often done through a FSA). If you have employees with daycare needs, this is a big one.

- Qualified Transportation Fringe: Things like transit passes or parking up to certain limits (around $300/month) can be provided tax-free.

Also, under the CARES Act provisions (extended through 2025), employers can contribute up to $5,250 toward an employee’s student loan payments tax-free to the employee – essentially extending the education assistance benefit to student loan repayment.

For S-Corp owner-shareholders (>2% owners) and partners in a partnership, many fringes (like health insurance, certain meals, lodging) are treated as taxable to the owner. But things like retirement contributions and education assistance can still be utilized via the business for employees.

From a planning perspective: Offering fringe benefits can reduce your taxable income (as deductions) while increasing the total compensation package to yourself or employees without increasing income tax burden on the recipient. If you’re going to spend money on yourself anyway (health insurance, commuting, etc.), running it through the business as a fringe (when allowed) can convert a personal expense into a pre-tax business expense.

Always ensure to follow any required formalities: some benefits require a written plan document and nondiscrimination testing to ensure you aren’t only benefiting owners or highly paid employees. When structured properly, fringe benefits are a fantastic tool in the tax planning for business owners toolkit.

Asset Acquisition and Management Strategies

Capital investments – buying equipment, vehicles, real estate, etc. – can have major tax implications. We touched on Section 179 and bonus depreciation earlier for deductions; here we focus on strategic ways to acquire and manage assets to minimize taxes over the long term.

Section 179 Deduction Opportunities

As discussed, Section 179 allows you to immediately expense qualifying asset purchases rather than depreciate them. The limit is very high (over $1 million), so most small businesses won’t hit it. The main considerations for Section 179 are:

- Qualifying Property: Almost all tangible personal property (machines, equipment, computers, furniture) qualifies. Certain vehicles (like heavy SUVs, pickups, and vans over 6,000 lbs GVW) qualify, though luxury auto limits can cap the deduction. Real property (buildings and their structural components) generally does not qualify, but improvements to non-residential buildings (roofs, HVAC, security systems, etc.) can qualify up to the limit.

- Business Income Limit: You cannot use Section 179 to create a tax loss. Your deduction is limited to your taxable profit from the business. If you bought $100k of equipment but your business only has $50k of income, you can only take $50k Section 179 this year (the rest can carry forward). This is where bonus depreciation can step in, since bonus can create a loss.

- State Conformity: Note that some states don’t follow federal Section 179 or have lower limits, which is a secondary consideration for planning (your state tax bill might differ).

- Elections: Section 179 is an election – you can choose how much of the cost to Section 179 (you don’t have to do the full amount). Sometimes you might elect out if, for example, you don’t need the deduction this year but expect higher income next year and the asset will still be depreciating then. But with bonus depreciation in play, that scenario is rarer (since bonus automatically depreciates a large portion unless you elect out of that too).

For tax planning, Section 179 is about timing. If you anticipate high income this year, making a capital purchase by Dec 31 could dramatically cut your tax. If you plan to buy assets early next year, see if accelerating the purchase into this year makes sense. Conversely, if you’re having a loss, Section 179 won’t help (can’t create or increase a loss), so you might deliberately hold off on electing 179 and let normal depreciation or bonus create or enlarge a Net Operating Loss (NOL) which could then carryforward.

Bonus Depreciation: What Qualifies and When to Use It

Bonus depreciation (currently 60%) covers most new and used assets with a class life of 20 years or less. That includes machinery, equipment, computers, furniture, certain land improvements, and qualified improvement property (QIP) for interiors of commercial buildings. It even covers business vehicles (subject to special limits for passenger vehicles, often called the “luxury auto” limits – e.g., first-year max deduction ~$20,200 in 2024 for a car if bonus is taken).

Key points for bonus depreciation in planning:

- No Income Limit: Unlike Section 179, bonus can create a loss. If you want to deliberately create an NOL (perhaps to carry forward against future profits, since carrybacks are limited in current law), bonus can do that.

- Automatic unless Opt Out: You don’t have to elect bonus – it’s automatic for new purchases. You’d elect out if you prefer to spread the deduction (perhaps to keep some income on the books or because of state non-conformity).

- Phase-Down: As mentioned, the bonus rate is 60% in 2024, then 40% in 2025, 20% in 2026, and 0% in 2027 onward (unless laws change). If you anticipate needing new equipment in the next few years, 2024 and 2025 purchases will get you a bigger immediate write-off than waiting until bonus is smaller or gone. That could factor into buy-versus-wait decisions.

Generally, between Section 179 and bonus, most small businesses can deduct 100% of asset purchases right away. The question becomes strategic: do you want 100% now, or does it benefit you to defer some deduction to future years (by opting out of bonus or not using 179)?

One reason to not take all depreciation at once is if you expect to be in a much higher tax bracket in the coming years. For example, maybe this year you’re in a 22% bracket, but next year you expect to be in 35%. You might want some depreciation to carry into next year when it saves you 35¢ on the dollar instead of 22¢. You could achieve that by electing out of bonus depreciation on that asset class, so the asset is depreciated normally over its life. This is advanced planning, but it’s a lever you can use.

Also note: If you use bonus or 179 to write off a vehicle and then you stop using it for business (or drop business use under 50%), you may have to recapture some depreciation. Be mindful of that if you expense a vehicle and later trade it in or use it personally more.

Strategic Timing of Major Purchases

Lastly, consider when to make major asset purchases from a tax timing perspective:

- End of Year vs Beginning: If you buy and place an asset in service on December 31, you basically get the same depreciation deduction as if you bought it in July (with bonus/179, you get full deduction regardless of in-service date during the year). So there’s a clear incentive to get a late-year purchase on the books to grab the deduction. Conversely, if you’re past December 31, 2024, and considering a purchase in early 2025, you could regret missing the higher bonus rate of ’24. Plan your capex according to the calendar year for maximum benefit.

- Avoid Mid-Quarter Convention Pitfall: If you don’t take bonus/179 and instead depreciate normally, be aware of the “mid-quarter convention.” If more than 40% of your depreciable personal property is placed in service in the last quarter of the year, depreciation for those assets is calculated from mid-quarter instead of mid-year, reducing first-year depreciation. Sometimes tax planners ensure not to trigger that by timing one purchase into early January instead of December, if they’re not using bonus/179.

- Lease vs Buy: Sometimes leasing equipment (with lease payments deductible) can smooth deductions over years, versus a big upfront hit with buying/179. This could be preferable if you anticipate steady income and want steady deductions, rather than a big deduction one year and nothing in later years. It’s more about financial/tax smoothing than overall deduction (lease vs buy often results in similar total deductions over time).

- Replacement of Assets: If you know you’ll need to replace an asset soon, consider the tax differences: trading in an old vehicle for a new one can defer gain into the new vehicle’s basis (like-kind exchange treatment for business vehicles was eliminated in 2018 for tax purposes, so now trading in a vehicle actually results in recognizing gain on the old one – a negative surprise for some). Selling an old piece of equipment for a gain will create income; if you plan a purchase, doing it in the same year can offset that with bonus. Plan the disposition of old assets alongside acquisition of new ones for optimal results.

Ultimately, tax planning for asset purchases boils down to: buy when you need it (don’t buy useless equipment just for a deduction – spending $1 to save $0.22 in tax is a losing proposition). But if you do need it, be smart about when and how you buy to maximize the tax benefit. Properly timed, a necessary purchase can also deliver a timely tax windfall.

Working Effectively With Tax Professionals

Even with the best DIY planning, the U.S. tax code is complex. Knowing when to seek professional help can save you time, stress, and yes, money. Accountants and tax advisors bring expertise to the table that can uncover savings you might miss and help you avoid costly mistakes. Tax planning for business owners often involves building a partnership with a tax professional.

When to DIY and When to Hire Help

Some small business owners handle their own taxes, especially in the early, simpler stages. DIY tax filing can work fine if your situation is straightforward: a single business with modest income, only a few expense categories, and no employees or special circumstances. It certainly saves on prep fees – a basic Schedule C filing might cost $300-$500 if outsourced, which you might prefer to keep in your pocket during lean startup years.

However, as your business grows, consider hiring a CPA or tax advisor when you encounter:

- Business Structure Changes: If you’re moving from sole proprietor to an LLC or S-Corp, or adding partners, definitely consult a professional. The tax implications (and paperwork) jump significantly.

- Multiple Income Streams: Say you have a consulting LLC and you started an e-commerce side business, and maybe also rental property. Juggling various schedules and potential interrelated tax rules gets tricky fast.

- Complex Deductions/Credits: If you plan to claim less common credits (like R&D credits) or deductions with many rules (like the home office, which you can handle DIY, but some are more complex such as cost segregation on real estate, etc.), a pro can navigate these.

- Big Life Events: Marriage, divorce, having kids (opens up credits), buying a house, etc., can all affect tax strategy.

- Worries About Errors or Audits: If your tax return is getting thicker each year and you’re losing confidence that you know all the rules, it’s time for help. The cost of an accountant might be far less than the cost of an audit adjustment from a mistake.

Keep in mind, professional tax planning isn’t just about filling out forms. It’s about having strategy sessions mid-year or before year-end to proactively plan moves. Professionals keep up with constantly changing tax laws (for example, the wave of tax law changes from the 2017 TCJA to the 2020 CARES Act to the SECURE Acts, etc.). They can advise you on new opportunities or pitfalls.

As a rule of thumb: if doing your taxes is consuming time you could better spend on your business (or with family), or causing you stress and uncertainty, delegate it to a professional. Your time is valuable, and tax strategy is their expertise.

Questions to Ask When Hiring a Tax Advisor

Choosing the right tax professional is important. Here are a few questions and considerations when vetting an accountant or tax advisor for your small business tax planning needs:

- Are you a CPA or EA (Enrolled Agent)? These credentials show a level of professionalism and expertise. A CPA has a broad accounting background (and can represent you in audits). An EA specializes in tax and can also represent you before the IRS.

- Do you have experience with small businesses in my industry? Industry knowledge can be a plus (they might know, for instance, that in your state, a certain credit applies to manufacturers, or common deductions for photographers, etc.).

- What services do you provide beyond tax preparation? Ideally, you want someone who will advise on bookkeeping, tax planning, and even things like retirement planning – a more holistic advisor.

- How do you bill? Hourly, flat fee per return, monthly retainer? Make sure it’s clear. Also ask about fees for consultations outside of tax season.

- How proactive are you in planning? Will they meet with you mid-year to review tax projections? Can you email them with questions in advance of major decisions? You want someone who will help plan, not just crunch numbers after the year is over.

- What’s your approach to dealing with the IRS? If an issue or audit comes up, will they handle it? Many CPAs include audit response as part of their service (or for an additional fee or insurance). Peace of mind is valuable.

Remember, you are essentially hiring a partner for your business’s financial health. Communication and trust are key. If they ever suggest anything that sounds too good to be true or encourages cutting corners, that’s a red flag. A good advisor will find you savings within the law and will be upfront about any aggressive positions.

Lastly, ensure you feel comfortable asking them questions. Taxes are complicated, and a great accountant educates their clients. If they act annoyed or talk over your head without clarifying, find someone else. It’s your money and your liability, so you should understand the broad strokes of what’s being done.

The chart above shows the rising trend in finance & accounting outsourcing (FAO) among businesses. As companies grow, many are turning to outsourced CFOs, accountants, or bookkeepers to handle complex financial and tax matters. This trend underscores that knowing when to bring in professional help is itself a smart business tax planning strategy.

How to Prepare for Tax Planning Meetings

To get the most value out of working with a tax pro, come prepared. Here’s how to make your meetings (whether at tax time or during planning sessions) as productive as possible:

- Keep Organized Records: Throughout the year, maintain a well-organized set of books (using software like QuickBooks or Wave, or even a detailed spreadsheet). Come tax time, provide your profit & loss statement, balance sheet, and cash flow if available. If your records are a mess, the CPA will spend time (and bill you) cleaning up, leaving less time for actual planning and strategy.

- Bring Prior Returns: If it’s your first meeting, bring the last couple of years’ tax returns. A new accountant can review them for any missed opportunities or issues and also use them as a baseline for future planning.

- List of Questions or Concerns: Jot down any tax-related questions that have been on your mind. Example: “Should I incorporate?” “Can I deduct my cell phone and how much?” “What’s the best way to save for my kids’ college from a tax perspective?” A good advisor will happily address these – that’s what you’re paying for.

- Major Changes Info: Inform them of anything new: “I hired my first employee in June,” or “I started selling on Amazon in addition to my service business,” or “I moved to another state.” These all have tax implications.

- Ideas You’ve Heard: Don’t hesitate to bring up strategies you’ve heard about (perhaps from this guide!). For instance, “I heard I could hire my teenager in the business and it’d be tax-free up to a certain amount – is that true for me?” This allows your CPA to validate and implement relevant strategies or caution you if something doesn’t apply.

Ultimately, collaborating closely with your tax professional turns them into an advisor throughout the year, not just a form-filler in spring. Provide information promptly when they request it, and review the returns or plans they prepare – make sure you understand the major items. This teamwork approach ensures your tax planning is tailored to your goals and situation.

(Internal Link: For specialized assistance in proactive tax strategy and compliance, consider Gnesist’s own Strategic Tax Planning services. Our professionals work year-round with small business owners to implement many of the strategies discussed in this guide.)

Conclusion

Mastering small business tax planning requires careful attention to detail, strategic timing, and a thorough understanding of the tax rules that apply to you. By being proactive and implementing the right strategies, you can save thousands while staying fully compliant with tax laws.

The impending changes in tax law – like the expiring 20% pass-through deduction and higher tax rates after 2025 – make proactive planning even more essential. Don’t wait until crunch time in April to think about taxes. Instead, treat tax planning as an integral part of running your business throughout the year.

Let’s recap some key takeaways:

- Maintain Accurate Records: Good bookkeeping is the foundation of all tax savings. Without accurate records, you will miss deductions and could run into trouble substantiating your expenses.

- Maximize Deductions: From home office use to vehicle expenses and equipment purchases, ensure you’re claiming all ordinary and necessary business expenses. As highlighted, you can generally deduct all legitimate business expenses – your job is to document them and choose the best method (standard mileage vs actual expenses, Section 179 vs normal depreciation, etc.) to maximize the write-off.

- Strategic Timing: Use year-end planning to defer income or accelerate expenses when it makes sense. Spread income and deductions across years in a way that minimizes your overall tax across those years. This includes contributions to retirement plans which not only save tax but build your future.

- Leverage Tax-Advantaged Accounts: Retirement plans, HSAs, FSAs, and other accounts allow you to put money aside for specific purposes with tax benefits. Every small business owner should consider at least a SEP IRA or Solo 401(k) once profitable – it’s a cornerstone of tax planning for business owners.

- Utilize Credits and Fringe Benefits: Tax credits (when applicable) are even better than deductions (dollar-for-dollar reduction of tax). And providing certain fringe benefits can give you deductions while giving employees (or yourself, as an employee of your company) value tax-free.

- Periodic Reviews: Taxes aren’t “set and forget.” Review your strategy whenever laws change or your business situation changes. For example, if you move from no employees to a few employees, revisit whether your S-Corp still makes sense or if a SIMPLE IRA plan could now be useful.

- Get Professional Help When Needed: As you saw, tax planning can get complex. A good CPA or tax advisor can be a valuable partner, helping implement all the strategies above and alerting you to new opportunities.

By implementing these strategies now – not waiting until the last minute – you ensure your business operates at peak tax efficiency. This means more cash in your business, less paid to Uncle Sam, and greater peace of mind. Remember, every dollar saved in taxes is a dollar that can be reinvested to grow your business or improve your personal financial security.

In the end, a comprehensive tax strategy aligned with your business goals is as important as your sales or marketing strategy. Make tax planning a habit. Your future self (and your bottom line) will thank you.

Meta Description: Small business tax planning is essential to reduce your tax burden and boost profits. Learn expert tax planning for business owners – from maximizing deductions and timing income to retirement strategies and hiring family – to save money and stay compliant with confidence.

FAQs

Q1. What is the most tax-efficient structure for a small business?

The most tax-efficient structure often depends on your specific situation, but many small businesses find LLCs advantageous. LLCs offer flexibility in taxation, allowing you to avoid double taxation by having profits pass through to your personal tax return. However, it’s best to consult with a tax professional to determine the optimal structure for your unique business circumstances.

Q2. How can I effectively manage taxes for my small business?

Effective tax management for small businesses involves several key practices: hiring a qualified accountant, accurately reporting all income, maintaining detailed records, separating business and personal expenses, understanding your income types, correctly classifying your business, and properly managing payroll if you have employees. Implementing these practices can help you stay compliant and minimize your tax burden.

Q3. What are some basic tax planning strategies for small businesses?

Three fundamental tax planning strategies for small businesses are timing (controlling when income is recognized or expenses are incurred), income shifting (moving income to lower-taxed entities or time periods), and conversion (changing the character of income or expenses). Each strategy aims to exploit variations in taxation across different dimensions to reduce overall tax liability.

Q4. How much can my small business deduct on taxes?

Small businesses can generally deduct all ordinary and necessary business expenses without a specific dollar limit. However, certain categories like vehicle expenses, meals, and entertainment have specific limitations or rules set by the IRS. It’s crucial to keep accurate records and understand the specific deduction rules for each expense category to maximize your allowable deductions.

Q5. What are the key deadlines I should know for small business tax planning?

Important deadlines include quarterly estimated tax payments (typically due on April 15, June 15, September 15, and January 15), year-end tax moves (by December 31), and tax filing deadlines (March 15 for partnerships and S-corporations, April 15 for sole proprietors and C-corporations). Additionally, retirement plan contribution deadlines vary, with some allowing contributions up until the tax filing deadline, including extensions.